Why Amazon Stands Out as a Smart Investment Opportunity

Before making a decision on a stock purchase, I always take a moment to review what Wall Street analysts have to say. This step may not be the final factor in my decision-making process, but it’s an important one to avoid overlooking crucial information.

For those interested in Amazon (NASDAQ: AMZN), analysts have set an average one-year price target of $224, suggesting a 20% upside from the current price. Notably, 45 out of 47 analysts rate Amazon as a buy, with the remaining two recommending a hold.

I tend to agree with the majority; I believe Amazon is a compelling buy at this moment.

Why Amazon’s Service Divisions Drive Investment Interest

Many recognize Amazon for its extensive e-commerce platform, offering a wide array of products. However, this may not be the best reason to invest in the company, as this segment typically operates on low margins and is experiencing slow growth, with a year-over-year sales increase of just 5% in the second quarter.

The more appealing aspects of Amazon lie within its service divisions. The company has three key segments that contribute significantly to its revenue: third-party seller services, advertising services, and Amazon Web Services (AWS).

The third-party seller services segment has become essential to Amazon’s business model. It ranks as the second-largest revenue segment, adding significant profit without much risk. Amazon’s investment in a vast warehouse and logistics network enables it to support third-party sellers, easing inventory management since sellers maintain their own product stocks.

Advertising has emerged as a rapidly growing segment for Amazon. It recorded a 20% revenue increase in the second quarter, with management suggesting this is just the beginning, especially in the realm of video advertising. This advertising revenue also bolsters the company’s overall profit margins, which have improved in recent years.

Lastly, AWS remains the largest cloud provider by market share. Despite a tough 2023, AWS has rebounded impressively as new AI workloads have been introduced, fueling growth for three consecutive quarters. I anticipate this trend will continue when AWS reports its third-quarter results this month. Notably, AWS contributes 64% of Amazon’s operating profits, despite accounting for only 18% of the total revenue.

Overall, Amazon continues to thrive, with its fastest-growing segments also being its most profitable, resulting in enhanced profit margins.

Amazon’s Current Valuation: Is It Too High?

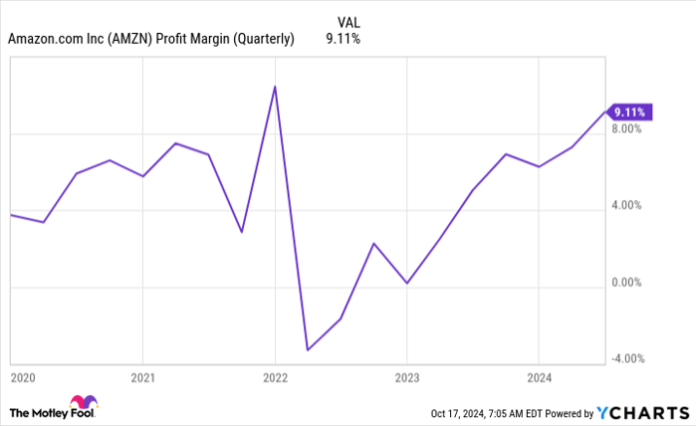

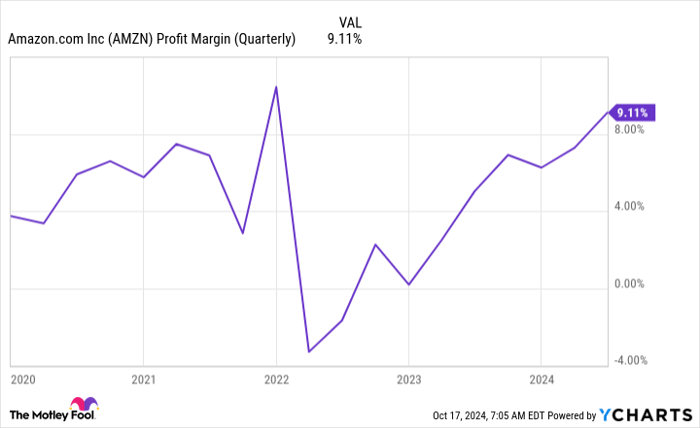

Following a drop in profit margins in 2022 due to overspending, Amazon has shown significant efficiency improvements in recent quarters.

AMZN profit margin (quarterly); data by YCharts.

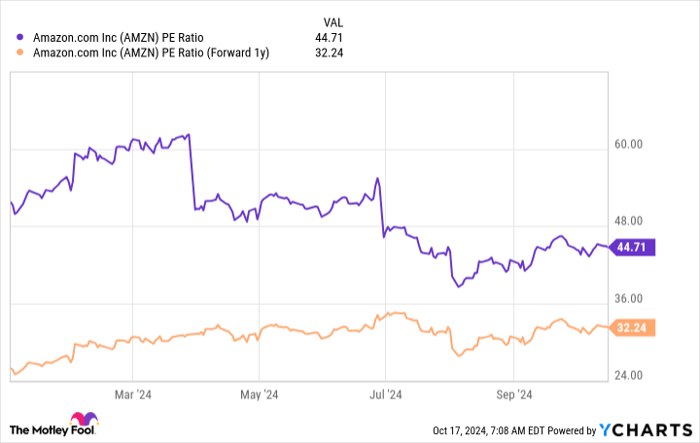

Investors will keep an eye on profit margins to ensure continued growth. However, the current valuation appears steep, with a trailing price-to-earnings (P/E) ratio that reflects this trend.

AMZN PE ratio; data by YCharts.

When considering projected earnings for 2025, the valuation seems more sensible, though it still carries a degree of expense. Amazon is poised for growth, especially if its key segments continue to expand profits. If it maintains this momentum, it could outperform Wall Street’s average one-year price target of $224.

Is Now the Right Time to Invest $1,000 in Amazon?

Before you decide to invest in Amazon, it’s important to consider the following:

The Motley Fool Stock Advisor team recently highlighted what they believe are the 10 best stocks to buy right now—and interestingly, Amazon was not included. The selected stocks have the potential to deliver impressive returns in the upcoming years.

Take Nvidia, for example. When this stock was recommended on April 15, 2005, an investment of $1,000 would now be worth $845,679!*

Stock Advisor offers a straightforward investment strategy, including advice on portfolio building, regular analyst updates, and two new stock picks each month. The service has more than quadrupled the returns of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.