Analysts Predict Strong Growth for Technology Select Sector SPDR Fund (XLK)

The Technology Select Sector SPDR Fund (Symbol: XLK) has analysts seeing potential upside based on its underlying holdings. Recent analysis shows an average target price of $255.21 per unit for XLK.

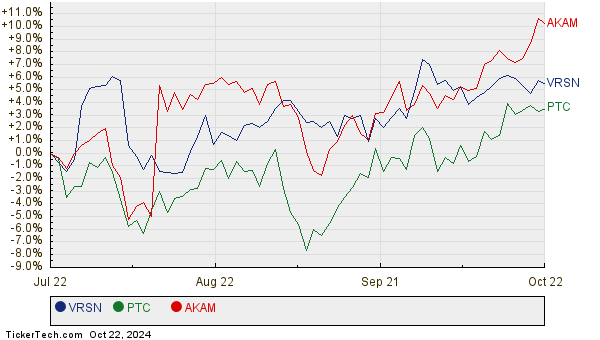

Currently trading at approximately $231.99, this suggests a promising upside of 10.01%. Among XLK’s holdings, notable stocks with significant expected growth include Verisign Inc (Symbol: VRSN), PTC Inc (Symbol: PTC), and Akamai Technologies Inc (Symbol: AKAM). Verisign, trading at $187.17, has an average target of $207.50, representing an upside of 10.86%. PTC, priced at $184.81, has a target price of $203.61, indicating a possible 10.17% rise. Analysts expect Akamai to increase to $116.94, marking a 10.17% growth from its current price of $106.15. Below is a chart illustrating the twelve-month price history for VRSN, PTC, and AKAM:

Here’s a summary of the current analyst target prices for the key stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| The Technology Select Sector SPDR Fund ETF | XLK | $231.99 | $255.21 | 10.01% |

| Verisign Inc | VRSN | $187.17 | $207.50 | 10.86% |

| PTC Inc | PTC | $184.81 | $203.61 | 10.17% |

| Akamai Technologies Inc | AKAM | $106.15 | $116.94 | 10.17% |

As analysts weigh their targets, investors might wonder whether these goals are realistic or overly ambitious. High targets can indicate optimism, but they may also lead to price downgrades if conditions change unexpectedly. It’s essential for investors to research thoroughly to understand the rationale behind these predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding BRP

• ATHM YTD Return

• Top Ten Hedge Funds Holding FLKS

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.