Market Analysts See Potential Gains in SPDR S&P MIDCAP 400 ETF

This report examines the outlook for the SPDR S&P MIDCAP 400 ETF Trust (MDY) based on its underlying stocks.

At ETF Channel, we analyzed the ETFs we cover, focusing on trading prices of their holdings and comparing these to average 12-month analyst target prices. For the SPDR S&P MIDCAP 400 ETF Trust (Symbol: MDY), the implied analyst target price stands at $632.18 per unit.

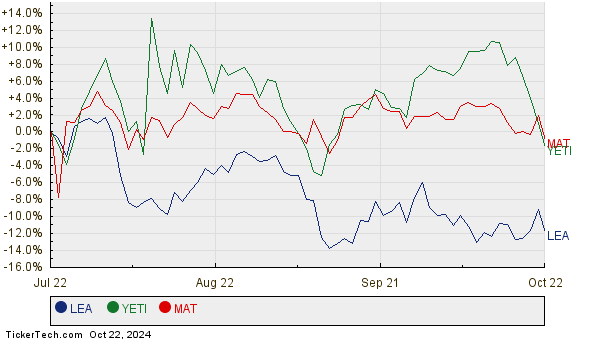

Currently trading at approximately $577.28 per unit, MDY shows an anticipated upside of 9.51% according to analyst predictions for its underlying holdings. Key stocks contributing to this outlook include Lear Corp. (Symbol: LEA), Yeti Holdings Inc. (Symbol: YETI), and Mattel Inc. (Symbol: MAT).

Lear Corp. trades at a recent price of $105.11, with analysts setting a target price 30.94% higher at $137.64. Similarly, YETI has an upside of 27.44% from its recent price of $37.14 to an average target price of $47.33 per share. Additionally, analysts expect Mattel to reach a target price of $23.36, which is 26.83% higher than its recent price of $18.42. Below is a chart displaying the performance of LEA, YETI, and MAT over the last twelve months:

Here’s a summary of the current analyst target prices mentioned above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P MIDCAP 400 ETF Trust ETF | MDY | $577.28 | $632.18 | 9.51% |

| Lear Corp. | LEA | $105.11 | $137.64 | 30.94% |

| Yeti Holdings Inc | YETI | $37.14 | $47.33 | 27.44% |

| Mattel Inc | MAT | $18.42 | $23.36 | 26.83% |

Do these analyst targets reflect realistic expectations, or are they overly optimistic about the future prices of these stocks? As we evaluate these insights, it is crucial to determine if analysts’ targets are well-justified by current market conditions, or if they represent outdated predictions. High price targets may indicate optimism, but they can also foreshadow potential downgrades if expectations do not align with actual performance. Investors should thus conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Market Cap History

• Funds Holding BCEI

• ENVB Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.