Utility Sector Gains Traction as Investors Eye Opportunities

Sector analysis shines a light on thriving areas in today’s market.

The traditionally stable utilities sector has entered a period of sustained growth. With improvements in energy infrastructure and grid modernization, this previously mundane market category is evolving rapidly.

Underappreciated by many, utility stocks may not yet reflect their potential in the coming years. As borrowing costs decrease, these stocks become more appealing, coupled with opportunities for considerable price increases.

With recent interest rate cuts by the Federal Reserve, the attractiveness of utility stocks is resurging. Lower rates enhance the appeal of utility dividends, driving up demand for these shares.

The Zacks Rundown

The utility sector includes companies that provide essential services like electricity, natural gas, and water, playing a vital role in public infrastructure.

The Zacks Utilities Sector ranks #2 among all 16 sectors, largely due to an increase in positive earnings estimates. Since it sits in the top half of Zacks Ranked Sectors, we anticipate this group will outperform the broader market over the next 3 to 6 months.

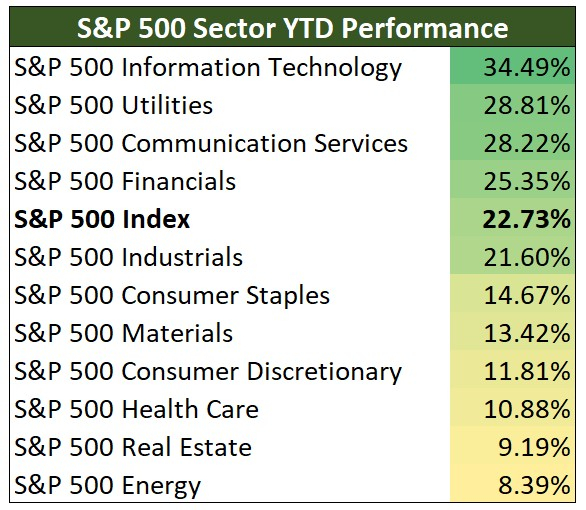

In 2024, utilities are the 2nd best-performing sector of the S&P 500, only behind technology:

Image Source: Zacks Investment Research

Stocks in the top half of Zacks Ranked Sectors outperform the bottom half by more than 2 to 1. Identifying these high-ranking areas can help investors significantly enhance their chances of success.

Understanding Options Essentials

Before diving into today’s trade, let’s revisit some basic options terminology. There’s no need for complex formulas. In my experience, simpler strategies often yield better long-term results.

Options are standardized contracts that provide the buyer the right — but not the obligation — to buy or sell stocks at a specified price, known as the strike price. A call option allows the buyer to purchase a stock, while a put option allows them to sell it.

The investor who acquires an option is referred to as the buyer, while the one selling it is termed the seller or writer.

These contracts are only valid for a defined period, concluding on the expiration date, which can be weekly, monthly, or long-term with LEAPS options that last over a year.

Options include time value and intrinsic value. In-the-money options have both, while at-the-money and out-of-the-money options consist only of time value. It’s important to remember that options lose all time value at expiration.

Next, let’s explore a strategy for purchasing call options.

Maximize Returns with Utility Options

The Utilities Select Sector SPDR ETF (XLU) is currently on an upward price trend, making it a suitable candidate for a call option purchase:

Image Source: StockCharts

When executed properly, trading options can offer significant profit opportunities with limited risks.

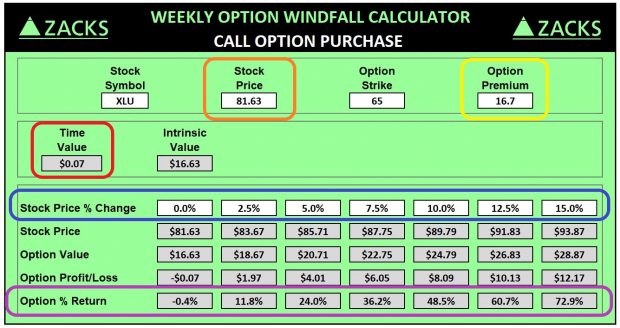

In today’s analysis, we’ll focus on a target expiration of December 20th with a 65-strike price. This means we have the right, but not the obligation, to buy 100 shares of the XLU ETF at $65 on or before December 20th, which is just around two months away.

The table below outlines the risk/reward profile for this particular trade. Currently, XLU is priced at $81.63 (as indicated by the orange box). We’re looking at purchasing one December 20 65-strike call at 16.7 points, which refers to the option premium. Since one option covers 100 shares of the underlying stock, the total investment for this call option will be $1,670, highlighted in yellow.

Image Source: Zacks Investment Research

The blue section in the top row displays XLU ETF performance against various percentage changes at expiration, while the purple section shows the anticipated returns for our call option trade. For instance, if XLU remains stable, our trade would result in a minor loss of 0.4%. A 5% rise in XLU would yield a 24% gain, while a 15% increase would provide a 72.9% profit.

This example highlights the leverage that options provide. An investor buying 100 shares of XLU would need to invest $8,163, yielding a profit of $1,224 from a 15% increase.

Conversely, the option trader requires only $1,670 to control the equivalent shares. A 15% rise in XLU stock would generate a profit of $1,217, almost identical to the stockholder’s profit but with just a fifth of the investment.

Additionally, it’s worth noting that this option has minimal time value, amounting to just 0.07 points (shown in red), which is less than 0.1% of the stock price. To mitigate risk when purchasing call options, it’s wise to minimize time value while maximizing intrinsic value, as time value tends to decrease quickly as expiration approaches.

Conclusion

The utility sector is experiencing positive earnings estimate revisions, securing a strong ranking that exceeds the broader market. The XLU ETF showcases a solid upward trend, offering diversification benefits.

A strategic way to capitalize on this sector’s growth is through low-risk call options, allowing us to leverage potential utility stock gains. Keep an eye on this market pocket as we enter the year’s final months.

Prepare for the Infrastructure Stock Boom

A substantial nationwide initiative to repair and enhance the United States infrastructure is imminent. This bipartisan effort is urgent and inevitable, with trillions of dollars at stake and numerous fortunes expected to be created.

The key question remains: “Will you invest in the right stocks early enough to maximize growth potential?”

Zacks has prepared a Special Report to assist you in making informed decisions. This report is free and highlights five specific companies poised to benefit from massive spending on infrastructure, including road, bridge, and building projects, along with cargo transport and energy transformation on a grand scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double. Click here to access this report.

Utilities Select Sector SPDR ETF (XLU): ETF Research Reports

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.