Freeport-McMoRan Sees Earnings Rise Despite Mixed Operational Results

Freeport-McMoRan Inc. (FCX) reported profits attributable to common stock of $526 million, or 36 cents per share, for the third quarter of 2024. This represents an increase of approximately 16% from last year’s $454 million, or 31 cents per share.

After adjusting for one-time items, earnings per share stood at 38 cents, falling short of the Zacks Consensus Estimate of 40 cents.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Revenue grew about 17% year-over-year, totaling $6,790 million, exceeding the Zacks Consensus Estimate of $6,459.6 million. This increase was primarily driven by higher copper and gold prices.

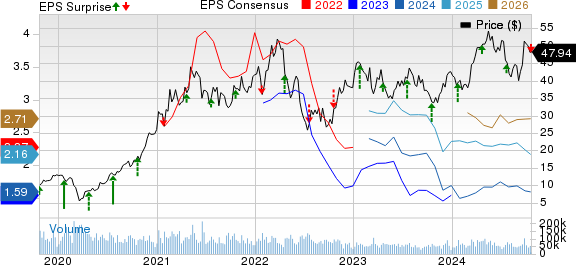

Freeport-McMoRan Earnings Overview

Freeport-McMoRan Inc. price-consensus-eps-surprise-chart | Freeport-McMoRan Inc. Quote

Key Operational Insights

Copper production dipped roughly 3% year-over-year, totaling 1,051 million pounds for the quarter, but slightly exceeded our estimate of 1,047 million pounds.

Consolidated sales of copper fell about 7% year-over-year, coming in at 1,035 million pounds, and also surpassed our estimate of 1,010 million pounds. This decline was largely attributed to shipment timing and lower ore grades along with operating rates in North America.

Gold sales dramatically increased, with 558,000 ounces sold, reflecting a 40% year-on-year increase. However, molybdenum sales decreased to 19 million pounds from 20 million pounds reported in the prior year.

The average unit net cash cost for copper dropped to $1.39 per pound from $1.73 a year ago, which was below our estimated $1.71.

The average realized copper price rose 13% year-over-year to $4.30 per pound, surpassing our estimate of $4.28. Gold also saw a significant price increase, climbing 35% to $2,568 per ounce, exceeding our prediction of $2,367.

Financial Position Overview

At the end of the quarter, Freeport’s cash and cash equivalents stood at $5 billion, marking a decline of approximately 5% from the previous quarter. Total debt increased by roughly 3% year-over-year, totaling $9,679 million.

Cash flows from operations reached about $1.9 billion, reflecting a substantial increase of 51% compared to last year.

Future Guidance for FCX

For 2024, Freeport anticipates consolidated sales volumes of approximately 4.1 billion pounds of copper, 1.8 million ounces of gold, and 80 million pounds of molybdenum. This guidance includes fourth-quarter projections of 980 million pounds of copper, 340,000 ounces of gold, and 20 million pounds of molybdenum.

Unit net cash costs for copper are expected to average $1.58 per pound for 2024, with a forecast of $1.72 per pound for the fourth quarter.

The company projects operating cash flows to be around $6.8 billion for 2024, while capital expenditures for the year are expected to be about $4.6 billion.

Stock Performance Analysis

In the past year, Freeport’s shares have risen by 43.1%, in contrast to a 50% increase in the Zacks Mining – Non Ferrous sector.

Image Source: Zacks Investment Research

Zacks Rank and Competitive Picks

Currently, FCX holds a Zacks Rank #3 (Hold).

Other companies in the Basic Materials sector with better rankings include IAMGOLD Corporation (IAG), DuPont de Nemours, Inc. (DD), and AdvanSix Inc. (ASIX), all holding a Zacks Rank #2 (Buy). For those interested, the complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be accessed here.

IAMGOLD is set to announce its third-quarter results on November 7, with the Zacks consensus estimate for earnings pegged at 12 cents. Notably, IAMGOLD has consistently beat consensus estimates over the last four quarters, averaging a surprise of 200%. Its stock has surged around 158% in the past year.

DuPont will report its third-quarter outcomes on November 5, with a consensus estimate of $1.03 per share. Over the last year, its shares have appreciated by roughly 17%.

AdvanSix is scheduled to report on November 1, with earnings expectations set at 66 cents per share. The company has seen its stock increase approximately 7% year-over-year.

Anticipating an Infrastructure Surge Across America

A significant initiative to upgrade U.S. infrastructure is soon to commence. This bipartisan effort is urgent and promises substantial financial engagement, with trillions expected to be spent. Profits will be substantial for those positioned wisely.

The pressing question remains: “Will you seize the opportunity to invest in the right stocks before they reach their fullest growth potential?”

Zacks has prepared a Special Report for investors, currently available at no cost. This report outlines five key companies poised to benefit from extensive construction and repair efforts across roads, bridges, and buildings, alongside cargo transportation and energy transformation initiatives.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Interested in receiving the latest recommendations from Zacks Investment Research? You can access the free report “5 Stocks Set to Double” today.

Freeport-McMoRan Inc. (FCX) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

IAMGOLD Corporation (IAG) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.