Ford Set to Report Q3 Results Amid Mixed Signals

Key Earnings Estimates Before Market Close

Ford (F) is expected to release its third-quarter 2024 results on Oct. 28, after the market closes. The Zacks Consensus Estimate predicts earnings of 49 cents per share and automotive revenues of $41.2 billion for the quarter.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

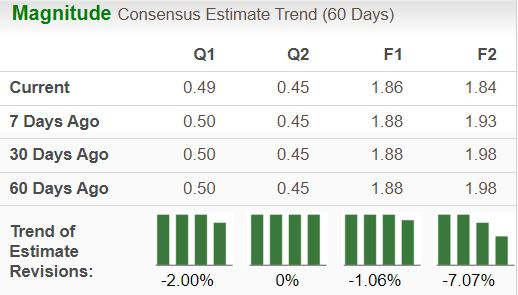

Recent Changes in Earnings Projections

In the past week, the earnings estimate for Ford’s upcoming quarter has decreased by 1 cent. However, this represents a significant year-over-year growth of 25.6%. Revenue estimates are almost unchanged compared to the same period last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Annual Revenue Outlook and EPS Forecast

For the current year, the Zacks Consensus Estimate for Ford’s automotive revenues stands at $170.7 billion, indicating a year-over-year increase of 2.8%. The full-year EPS consensus estimate is $1.86, projecting a 7.5% decline compared to last year.

Recent Earnings Performance

In the past four quarters, Ford has exceeded EPS expectations twice and missed twice, achieving an average earnings surprise of 32.32%.

Ford Motor Company Price and EPS Surprise

Ford Motor Company price EPS surprise | Ford Motor Company Quote

Analysis of Q3 Earnings Outlook

Current indicators do not ensure an earnings win for Ford this time. A positive Earnings ESP (Earnings Surprise Prediction) combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) usually increases the likelihood of a beat. Ford, however, has an Earnings ESP of +1.22% but carries a Zacks Rank of #5 (Strong Sell).

Must-Watch Metrics for Ford’s Q3

Ford’s U.S. sales saw a slight rise of about 1% year over year, totaling 504,039 units in Q3 2024. Retail sales climbed 4% from the same time last year, driven by its powertrain offerings. However, sales of internal combustion engine vehicles fell by 2.8%, while electric and hybrid vehicles grew 38% and 12%, respectively. Ford ranked as the #3 EV brand in the U.S. during the quarter, selling 23,509 electric vehicles.

Here’s a summary of estimates for Ford’s revenues and EBIT (Earnings Before Interest and Taxes) for key segments for the three months ending on September 30:

- The Zacks Consensus Estimate for the Ford Blue unit (which includes ICE and hybrid models) anticipates revenues of $23.78 billion, down 7% from last year. The EBIT estimate is $1.87 billion, an increase from $1.72 billion in Q3 2023.

- For the Ford Model e unit (electric vehicles), revenues are expected to be $1.39 billion, a decrease from $1.75 billion during the same period in 2023. The EBIT loss is predicted to be $1.18 billion, an improvement from the $1.33 billion loss last year.

- The Ford Pro unit (commercial vehicles and services) is projected to generate $16.6 billion in revenues, reflecting a 19.9% increase year over year, with an EBIT forecast of $2.1 billion compared to $1.65 billion in Q3 2023.

Ford’s Stock Performance and Valuation

Over the previous six months, Ford has lagged behind the industry, sector, S&P 500, and its primary competitor, GM.

6-Month Price Performance

Image Source: Zacks Investment Research

Valuation Perspective

Currently, Ford is viewed as relatively cheap in terms of valuation. The company’s forward price/sales ratio stands at 0.26, which is below its five-year median of 0.31. Additionally, this ratio is a discount compared to the industry’s 1.57.

Image Source: Zacks Investment Research

Challenges Cloud Ford’s Outlook

Although Ford’s Pro business is experiencing growth, overall prospects are hindered by serious issues in its other segments, notably the EV side. Revenues from the Model e unit dipped nearly 50% year over year in the first half of 2024, leading to an operating loss of about $2.5 billion. Following a loss of $4.7 billion in its EV business last year, Ford expects this figure to escalate to $5-$5.5 billion this year due to ongoing pricing pressures and increased investments in next-gen EVs.

Similarly, the Blue unit is also showing signs of slow growth. High warranty costs add to the challenges, with $2.3 billion spent on warranty and recall expenses in Q2 2024. Although the company is focused on improving the quality of its newer models, it might take up to 18 months until these improvements lead to cost reductions. Consequently, Ford may continue to face significant warranty expenses for the foreseeable future.

In summary, while Ford’s low valuation and attractive dividend yield are appealing, they are overshadowed by increasing financial difficulties and operational challenges. Given the escalating losses in the EV sector and other competitive pressures, investors may want to keep their distance from Ford stock for now as the company navigates these hurdles.

Infrastructure Stock Boom Expected

A significant effort to rebuild the decaying U.S. infrastructure is on the horizon. This bipartisan initiative promises to be urgent and substantial, with trillions of dollars earmarked for this purpose. It presents an opportunity for potential riches.

The pressing question is whether you’ll invest in the right stocks early on when their growth potential is at its peak.

Zacks has released a free Special Report to assist investors in identifying such stocks, highlighting five special companies likely to benefit from the massive spending on infrastructure projects.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Download today to access 5 Stocks Set to Double – all for free.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.