Pentair Beats Earnings Estimates in Q3 2024: A Closer Look at the Numbers

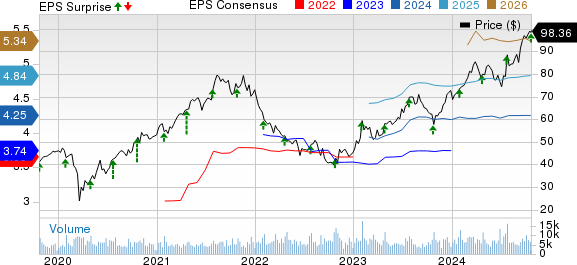

Pentair plc PNR reported its adjusted earnings per share (EPS) for the third quarter of 2024 at $1.09, outpacing the Zacks Consensus Estimate of $1.07. This result also exceeded the company’s guidance range of $1.06 to $1.08 and showcased a 14% increase from the 94 cents per share reported in the same quarter last year.

When factoring in one-time items, the EPS stood at 84 cents, compared to 79 cents in the prior-year quarter.

Net sales for the quarter fell by 1.5% year over year, totaling $993 million. Despite this decline, the figure surpassed the Zacks Consensus Estimate of $990 million. When excluding the effects of acquisitions, divestitures, and currency fluctuations, core sales experienced a 1% drop in the quarter.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The cost of sales decreased by 5.8% year over year to $600 million, resulting in a gross profit of $393 million, which is a 5.8% increase from the previous year. The gross margin improved to 39.6%, compared to 36.9% in the year-ago quarter.

Selling, general and administrative (SG&A) expenses amounted to $190 million, reflecting a 14.6% rise from $166 million in the prior-year quarter. Research and development expenses saw a decline of 10.2% year over year, totaling $22.9 million.

The operating income for this quarter remained flat at $180 million, consistent with the prior year’s results. Operating margin was reported at 18.1%, compared to 17.9% in the same period last year.

Pentair’s Q3 Segment Performance Overview

Net sales from the Flow segment were $372 million, down 7% from last year, while operating earnings increased by 6.8% to $83 million, slightly above our estimate of $82 million.

In the Water Solutions segment, net sales declined by 3.3% to $290 million, with earnings at $64 million, which fell short of our $69 million estimate.

The Pool segment, however, showed resilience with a 7.3% year-over-year increase in net sales, reaching $331 million. Operating earnings in this segment grew by 24.4% to $112.7 million, surpassing our estimate of $107 million.

Cash Flow & Balance Sheet Insights

Pentair’s cash and cash equivalents totaled approximately $218 million at the end of the third quarter, up from $170 million at the end of 2023. The net cash generated from operating activities stood at $680.4 million for the first nine months of the year, compared to $502.3 million for the same period last year. The company’s long-term debt decreased to $1.63 billion as of September 30, 2024, from $1.99 billion at the end of 2023.

On September 23, Pentair announced a regular quarterly cash dividend of 23 cents per share, set to be paid on November 1, 2024, to shareholders recorded by the close of business on October 18, 2024.

In the third quarter, the company repurchased 0.6 million of its shares for $50 million, maintaining $500 million available under its share repurchase authorization as of September 30, 2024.

Looking Ahead: Q4 & 2024 Guidance

Pentair is projecting an adjusted EPS of $4.27 for 2024, an increase from its previous estimate of $4.25. This forecast represents a 14% growth from the $3.75 adjusted EPS reported in 2023. For 2024, sales are expected to remain flat or decline 1% compared to 2023.

For the fourth quarter, the company anticipates an adjusted EPS of $1.02 and expects a sales decline of 1-2% from the same quarter last year.

Stock Performance Overview

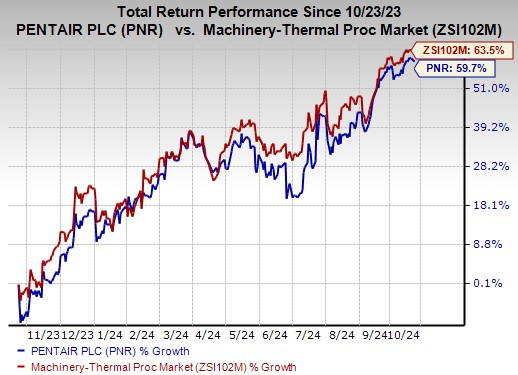

Over the past year, Pentair’s stock has increased by 59.7%, which is slightly below the industry’s growth of 63.5%.

Image Source: Zacks Investment Research

Upcoming Earnings Releases

Pool Corp. POOL is scheduled to report its third-quarter results on Oct. 24. The Zacks Consensus Estimate for POOL’s earnings is $3.15 per share, marking a projected year-over-year decline of 10%. Net sales are expected to reach $1.41 billion, a 4.7% decrease from the previous year. Notably, POOL has a trailing four-quarter average surprise of 1.2%.

Zebra Technologies Corporation ZBRA is set to release third-quarter results on Oct. 29 with a Zacks Consensus Estimate of $3.24 per share, indicating a significant increase from 87 cents in the prior year. However, the top line is expected to fall by 26.5% to $1.21 billion, alongside an average surprise of 11.9% over the last four quarters.

Pentair’s Market Position & Considerations

Currently, Pentair holds a Zacks Rank #2 (Buy). Additionally, Parker-Hannifin Corporation PH, which also has a Zacks Rank #2, boasts a fiscal 2025 earnings estimate of $26.68 per share and a trailing four-quarter average earnings surprise of 11.2%. Parker-Hannifin shares have appreciated by 76.4% in the last year.

Infrastructure Investment on the Horizon

A significant push to revamp America’s infrastructure is about to commence, supported by bipartisan agreement and urgent needs. This initiative will see trillions spent, presenting lucrative investment opportunities.

If you want to capitalize on these potential gains, Zacks has prepared a Special Report detailing five companies positioned to benefit from this massive spending on infrastructure. Download it for free to uncover the details.

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Pool Corporation (POOL): Free Stock Analysis Report

Pentair plc (PNR): Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.