Exploring Pfizer’s Stock Value: A Look into Its Current Standing and Future Growth

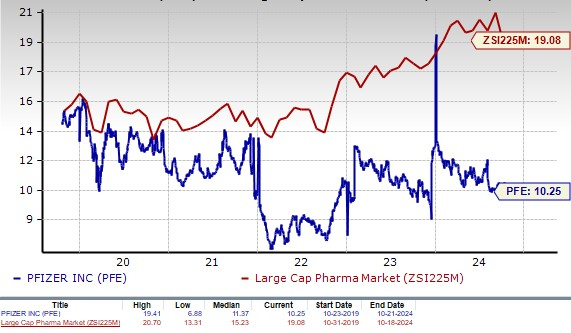

Drug giant Pfizer PFE is currently trading at a discounted price following a rough year after the pandemic. The stock is underperforming in comparison to the industry average and is also lower than its own five-year average. The price-to-earnings ratio shows that Pfizer’s shares are priced at 10.25 times forward earnings, while the industry average stands at 19.08, and Pfizer’s past five-year mean is 11.37.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In terms of price/sales ratio, Pfizer’s forward sales multiple is 2.63, which is below its five-year average of 3.28 and significantly lower than the industry standard of 7.17.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The current stock price also positions Pfizer as more affordable compared to other large drug firms such as AbbVie ABBV, Novo Nordisk NVO, and Lilly LLY.

Given the stock’s current discount, it’s essential to examine Pfizer’s potential for growth alongside its existing challenges to determine if it’s the right time for investors to allocate funds to Pfizer.

Declining Sales of COVID Products

Sales from Pfizer’s COVID-19 products, Comirnaty and Paxlovid, have seen a significant drop in 2023 due to reduced demand as the pandemic subsided. Looking ahead to 2024, Pfizer anticipates further declines in revenue from these products, estimating a combined revenue of $8.5 billion, down from $12.5 billion in 2023.

New Drug Developments and Acquisitions Driving Growth

Despite the downturn in COVID product sales, Pfizer’s non-COVID operational revenues have shown improvement in the first half of 2024. This growth is attributed to successful products like Prevnar, Vyndaqel, and Eliquis, along with new launches such as Abrysvo, Velsipity, and Penbraya. The firm’s acquisition of Nurtec and Seagen in December 2023 contributes to its growth trajectory, with expectations for this trend to continue in the latter half of the year.

The previous year marked a record for Pfizer, securing nine approvals from the FDA for new medicines and vaccines. This year, it also welcomed approval for new gene therapies targeting hemophilia, Hympavzi (marstacimab), and Beqvez/Durveqtix (fidanacogene elaparvovec).

The combination of new products and promising candidates in the pipeline, alongside acquisitions like Seagen, positions Pfizer for operational growth leading into 2025 and beyond. Pfizer aims for a compound annual growth rate (CAGR) of around 6% from 2025 to 2030, with the Seagen acquisition expected to bring in over $10 billion in risk-adjusted revenues by 2030.

Strengthening Position in Oncology

Pfizer stands among the top pharmaceutical companies in oncology, further enhanced by its partnership with Seagen. Currently, oncology sales account for more than 26% of the company’s total revenues. In the first half of 2024, oncology revenues rose by 23%, driven by key drugs such as Xtandi, Lorbrena, and the Braftovi-Mektovi combination. Additionally, Pfizer has entered the oncology biosimilars market, marketing six cancer-related biosimilars. With ongoing advancements in their oncology pipeline, Pfizer anticipates having eight or more blockbuster oncology drugs by 2030.

Stock Performance and Earnings Outlook

Over the past six months, Pfizer’s stock has increased by 9.9%, outpacing the industry’s 8.1% rise. Currently, it trades above its 200-day moving average.

PFE Stock Performance Compared to Industry

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Pfizer’s earnings has risen from $2.59 to $2.66 per share for 2024 over the last 60 days, and from $2.83 to $2.86 for 2025.

Earnings Estimate Adjustments for PFE

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Consider Investing in PFE Stock

After facing challenges in recent years, it appears that Pfizer’s toughest period is behind it, and the company is on the path to recovery.

Pfizer still wrestles with the declining sales of its COVID-19 products and anticipates significant impacts from the loss of patent exclusivity during the 2026-2030 period. Nonetheless, growth from its non-COVID drugs and potential revenues from new products looks promising.

Moreover, Pfizer maintains a strong dividend yield of around 6% while planning to save $4 billion in 2024 from cost cuts and restructuring measures, including layoffs. The additional cash flow from COVID products has supported acquisitions, enhanced dividend distributions, share buybacks, and debt reduction.

With increasing earnings estimates reflecting investor confidence, those holding this Zacks Rank #3 (Hold) stock may consider staying invested to monitor future performance. Long-term investors might find it appealing to acquire shares of this pharmaceutical leader at its current valuation.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon commence. This initiative is bicameral, urgent, and crucial. Trillions of dollars will be invested. New fortunes will be created.

The pressing question is whether you will invest in the right stocks early enough to maximize their growth potential.

Zacks has prepared a Special Report to aid you in this endeavor, available for free. Discover five companies poised to benefit most from construction and repair activities concerning roads, bridges, buildings, cargo hauling, and energy transformation.

Unlocking Opportunities in Infrastructure Spending

The push for massive infrastructure spending presents unique investment opportunities for savvy investors.

Download FREE: How To Profit From Trillions In Infrastructure Spending >>

For those interested in maximizing returns, Zacks Investment Research offers a report on 5 Stocks Set to Double. Get your free copy today!

Consider some leading healthcare stocks gaining attention:

- Pfizer Inc. (PFE): Free Stock Analysis Report

- Novo Nordisk A/S (NVO): Free Stock Analysis Report

- Eli Lilly and Company (LLY): Free Stock Analysis Report

- AbbVie Inc. (ABBV): Free Stock Analysis Report

For in-depth insights, you can click here to read the full article on Zacks.com.

Zacks Investment Research is a trusted source for investment insights.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.