Nvidia: The Leading AI Stock Driving Market Growth

Artificial intelligence (AI) markets are booming, and one AI stock shines brighter than the rest. While not strictly an AI company, this firm has become a vital supplier for the entire AI industry, playing a crucial role in the rapid innovations taking place globally.

Without this company, it’s likely that the current surge of AI development would not be happening at the same speed.

In May, this stock experienced such significant growth that management decided to implement a 10-for-1 stock split. Even after the split, shares soared an additional 60%, leading to an impressive 186% overall increase in valuation since January.

Meet Nvidia: This Year’s Top AI Performer

The standout performer in the AI sector is none other than Nvidia (NASDAQ: NVDA). The company holds a unique position within the AI supply chain, which explains why its shares have soared this year.

Nvidia is primarily a supplier of AI components rather than a dedicated AI company. Most AI models, particularly generative applications, require vast datasets and significant training to enhance their capabilities. This intense training demands specialized, high-powered chips, and Nvidia’s leading graphics processing units (GPUs), such as the H100 and A100 models, are highly regarded for these tasks.

Estimates suggest Nvidia commands a 70% to 95% share of the AI chip market, positioning it well to benefit as spending in AI infrastructure grows rapidly.

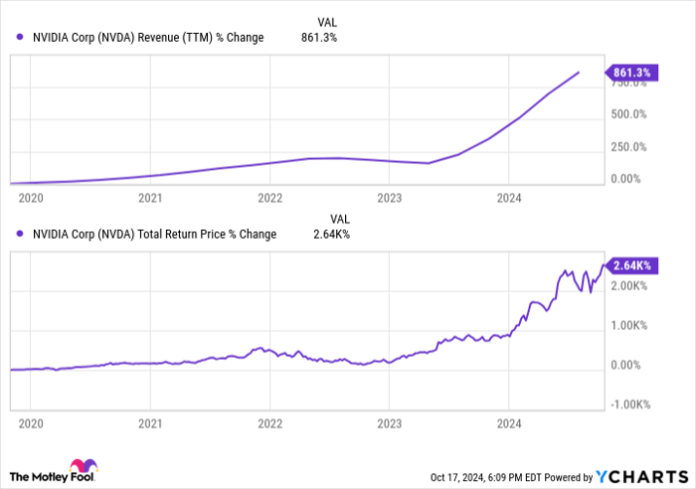

NVDA Revenue (TTM) data by YCharts

Can Nvidia Maintain Its Stock Surge?

Nvidia’s revenue is anticipated to climb steadily over the next few years. In fact, the overall AI infrastructure market is projected to grow at nearly 30% annually, while Nvidia’s sales are expected to jump by 126% this fiscal year.

However, the main concern for Nvidia is not the growth itself, but the sky-high expectations surrounding it.

The stock recently traded at a striking 35 times its sales, which is extraordinarily high. Despite a drop in revenue growth rates toward the industry standard, Nvidia’s valuation has stayed elevated.

Several quarters ago, Nvidia reported sales growth over 200% year-over-year, with a price-to-sales ratio fluctuating between 24 and 42. As September’s end approaches, forecasts imply a sales growth reduction to 125%, followed by a further decrease to just 42% next year. Still, the stock remains valued at the higher end of recent trends.

NVDA PS Ratio data by YCharts.

At its current valuation, much of the easy gains from Nvidia stock may have already been realized. Analysts predict that sales growth will align more closely with the industry average of about 30%.

Moreover, increased competition is expected over the coming years. The landscape of the chip industry often witnesses fierce competition that can shift market leadership amongst different companies.

Investors may want to prepare for potential declines in Nvidia’s gross margins, which are currently around 75%. For context, Intel and AMD report gross margins of 40% to 50%. Nvidia’s stronghold won’t collapse overnight, but as more players enter the AI infrastructure market, pressure on its margins is likely.

In a June interview with CNBC, 3Fourteen Research Chief Data Scientist Fernando Vidal noted, “Nobody can deny that today Nvidia is the hardware you want to train and run AI models. But there’s been incremental progress in leveling the playing field, from hyperscalers working on their own chips to even smaller start-ups designing their own silicon.”

So, is Nvidia still a wise choice for long-term investors interested in the ascent of AI? Yes. Investors can anticipate significant growth in Nvidia’s sales over the next decade, even if some competitive edges might fade over time.

However, those looking to invest must be patient. Rapid returns like those seen in the past may not be realized again soon.

Is Now a Good Time to Invest $1,000 in Nvidia?

Before purchasing Nvidia shares, consider this:

The Motley Fool Stock Advisor analyst team has recommended what they believe are the 10 best stocks to buy now, and Nvidia is not one of them. The selected stocks are projected to deliver exceptional returns in the upcoming years.

If you had invested $1,000 in Nvidia when it made this list on April 15, 2005, your investment would now be worth $880,670!*

Stock Advisor provides investors with a straightforward guide to success, including portfolio-building tips, regular updates from analysts, and two new stock picks each month. Since its inception, Stock Advisor has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.