Analysts Predict Growth for FNX and Its Key Holdings

Analyzing the ETFs tracked by ETF Channel reveals a promising outlook for the First Trust Mid Cap Core AlphaDEX Fund ETF (Symbol: FNX). The weighted average analyst target price for FNX is set at $128.75 per unit based on its underlying holdings.

Currently, FNX trades around $117.00 per unit, indicating a potential upside of 10.04% as analysts expect the ETF to reach their target prices. Noteworthy underlying stocks are Axsome Therapeutics Inc (Symbol: AXSM), Zeta Global Holdings Corp (Symbol: ZETA), and Revolution Medicines Inc (Symbol: RVMD). Despite AXSM trading at $92.39 per share, analysts target a higher average of $125.88 per share, representing a significant 36.24% upside. Likewise, ZETA shows an expected growth of 32.58% from its recent price of $26.40 to a target of $35.00 per share, while RVMD is predicted to rise 26.55% from $47.13 to $59.64.

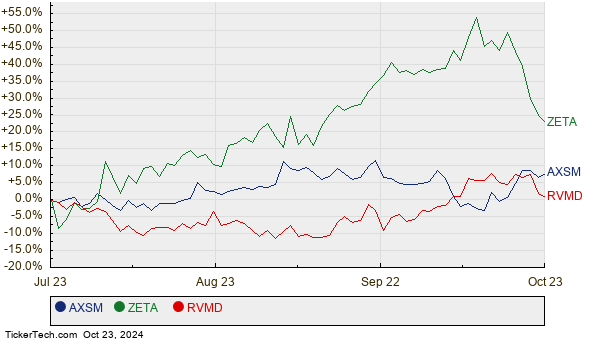

Below is a twelve-month price history chart comparing the stock performance of AXSM, ZETA, and RVMD:

Here’s a concise summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Mid Cap Core AlphaDEX Fund ETF | FNX | $117.00 | $128.75 | 10.04% |

| Axsome Therapeutics Inc | AXSM | $92.39 | $125.88 | 36.24% |

| Zeta Global Holdings Corp | ZETA | $26.40 | $35.00 | 32.58% |

| Revolution Medicines Inc | RVMD | $47.13 | $59.64 | 26.55% |

This brings forth the question: Are the analysts’ targets realistic or overly optimistic? Investors should consider whether the forecasts reflect current company performance and trends in the industry or if they are based on outdated expectations. Targets that are significantly higher than current prices may indicate optimism, but they could also lead to downgrades if market conditions change.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Funds Holding MNTK

DALS market cap history

HASI Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.