Builders FirstSource Set to Announce Q3 Earnings Amid Mixed Market Performance

Irving, Texas-based Builders FirstSource, Inc. (BLDR) is the largest U.S. supplier of building products, prefabricated components, and value-added services for residential construction, repair, and remodeling. With a market cap of $22 billion, Builders FirstSource serves professional homebuilders, sub-contractors, remodelers, and consumers in the U.S. The company plans to announce its Q3 earnings before market open on Tuesday, Nov. 5.

Analysts Project Decline in Profits

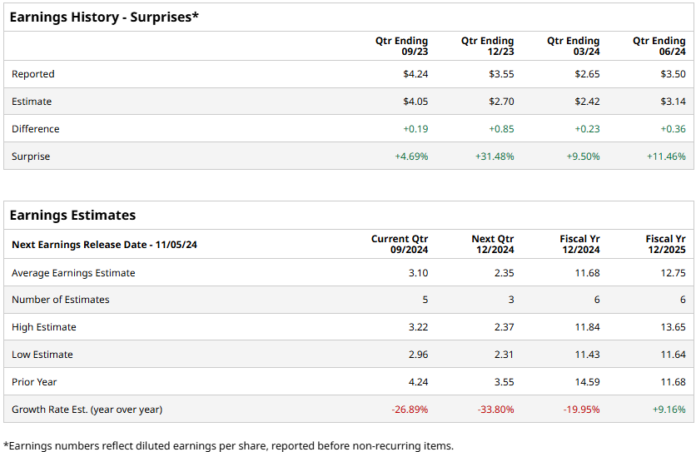

Analysts anticipate Builders FirstSource to report a profit of $3.10 per share, a decrease of 26.9% compared to the $4.24 per share reported in the same quarter last year. Notably, the company has exceeded Wall Street’s adjusted EPS predictions in the last four quarters. For the latest quarter, its adjusted EPS fell 10% year-over-year to $3.50, surpassing consensus estimates by 11.5%.

Future Earnings Outlook

Looking ahead, analysts expect an adjusted EPS of $11.68 for fiscal 2024, representing a 20% drop from $14.59 in fiscal 2023. However, fiscal 2025 projections look more promising, with expected growth of 9.2% year-over-year to $12.75 per share.

Stock Performance Compared to Industry

Year-to-date, BLDR has gained 8.2%, which trails behind the S&P 500 Index ($SPX) at 22.7% and the Industrial Select Sector SPDR Fund’s (XLI) 20.3% returns during the same period.

Q2 Earnings Report Sparks Stock Surge

Shares of Builders FirstSource rose 4.1% after the release of its Q2 earnings on August 6, which exceeded expectations. The company reported a 1.6% year-over-year decline in net sales to $4.5 billion, slightly missing Wall Street’s expectations. Additionally, core organic sales fell by 3.8%, mainly attributed to the downturn in the Multi-Family sector, though this was partially offset by growth from acquisitions and Single Family sales. Despite a 15% decline in net income to $344.1 million—due to a 121 basis points contraction in net margin to 7.7%—surpassing analysts’ adjusted EPS expectations led to the increase in stock price.

Analysts Maintain Bullish Stance

The consensus view on Builders FirstSource stock remains positive with a “Strong Buy” rating. Out of 16 analysts covering the stock, 11 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and four advise a “Hold” rating. The mean price target stands at $204, indicating a potential upside of 12.9% from current levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.