PowerFleet’s Stock Shows Promise with Analysts Eyeing Significant Gains

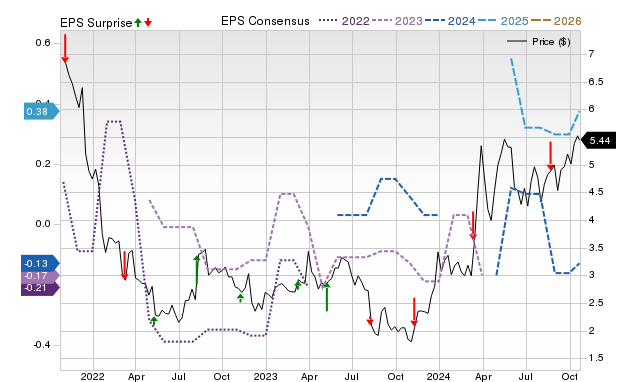

Shares of PowerFleet (AIOT) have risen 10.8% over the last month, closing the latest trading session at $5.44. Analysts point to a brighter outlook for the stock with a mean price target of $9, suggesting a potential upside of 65.4%.

Price Predictions and Variability Among Analysts

The average price target includes six short-term estimates, which range from a low of $7 to a high of $13, with a standard deviation of $2.28. While the lowest estimate indicates a potential increase of 28.7% from the current price, the most optimistic projection signals a 139% gain. The standard deviation reflects the agreement level among analysts—the smaller it is, the more consensus there is on the stock’s potential movement.

Although consensus price targets are popular among investors, there’s skepticism surrounding the reliability of analysts in setting these targets. Relying solely on this metric could lead to poor investment decisions.

Beyond Price Targets: Earnings Revisions Signal Optimism

Positive revisions in earnings estimates indicate that analysts foresee better performance for PowerFleet. This growing optimism could indicate that the stock might have room to rise. Historical data supports a strong correlation between earnings estimate revisions and stock price changes.

In the past 30 days, three earnings estimates have improved with no downward revisions, leading to a 20% increase in the Zacks Consensus Estimate for the current year.

PowerFleet Earns a Strong Zacks Ranking

PowerFleet currently holds a Zacks Rank of #2 (Buy), placing it among the top 20% of over 4,000 ranked stocks based on earnings factors. This ranking reflects a solid track record and further strengthens the argument for the stock’s potential growth.

Analysts Stress Skepticism About Price Targets

Despite the promising consensus price target, it shouldn’t be the only aspect considered. Analysts have, at times, set overly optimistic price points due to business incentives, which can skew the perceived outlook of a stock. However, if a tight grouping is observed among price targets, it can guide investors to explore the stock’s underlying fundamentals further.

Anticipated Growth for PowerFleet

In sum, while analysts’ price targets may not be foolproof, they do signal potential upward movement for PowerFleet’s stock. As analysts show increasing confidence in earnings, investors might find grounds for optimism regarding AIOT’s future performance.

Insights from Zacks’ Research Team

Our experts recently identified five stocks with the highest probability of more than 100% gains over the coming months. Among these, Director of Research Sheraz Mian has singled out one stock poised for exceptional growth.

This top pick comes from a leading financial firm boasting over 50 million customers and a range of innovative solutions. While not all recommended stocks succeed, this one could significantly exceed the performance of previous Zacks stocks like Nano-X Imaging, which soared +129.6% in just over nine months.

PowerFleet, Inc. (AIOT): Free Stock Analysis Report

To access the full article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.