Charles River Laboratories Sees Mixed Ratings and Funding Trends

Fintel reported that on October 23, 2024, CLSA started its coverage on Charles River Laboratories International (NYSE:CRL) with a Underperform rating.

Analysts Predict Modest Growth Ahead

As of October 22, 2024, the average price target for Charles River Laboratories International stands at $214.15 per share. This projection indicates a potential increase of 14.75% from its recent closing price of $186.63. Price targets range from a low of $152.51 to a high of $272.17.

Investors can explore the leaderboard of companies with the largest price target upside.

Revenue and Earnings Forecast

The estimated annual revenue for Charles River Laboratories International is $4,596 million, reflecting a growth of 12.71%. Meanwhile, the projected annual non-GAAP earnings per share (EPS) is 13.24.

Fund Sentiment Reported

Currently, 1,271 funds and institutions have a stake in Charles River Laboratories International, showing a slight decrease of 11 owners, or 0.86%, from the previous quarter. The average portfolio weight for all funds associated with CRL is 0.25%, which is an increase of 16.25%. Institutional ownership has risen by 1.53% in the last three months, totaling 59,393K shares.

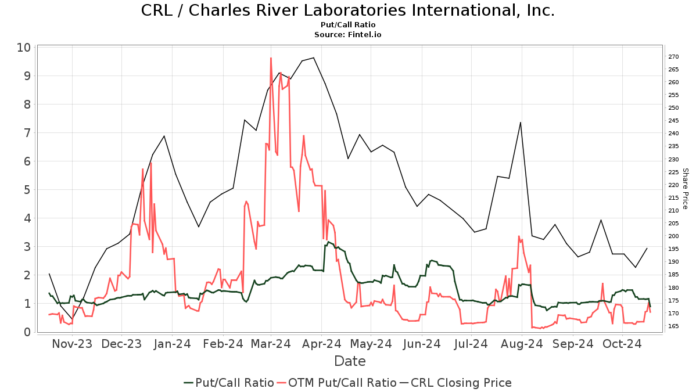

The current put/call ratio for CRL is 0.70, indicating a bullish sentiment among investors.

Kayne Anderson Rudnick Investment Management owns 1,909K shares, equating to 3.70% of the company. Their previous filing showed 1,878K shares, marking an increase of 1.64%, though they decreased their portfolio allocation in CRL by 42.88% in the last quarter.

Allspring Global Investments Holdings increased its holdings to 1,761K shares (3.41% ownership), up from 1,252K shares, representing a significant increase of 28.92%. However, they also reduced their portfolio allocation in CRL by 50.11% during the same period.

Vanguard Total Stock Market Index Fund Investor Shares holds 1,637K shares (3.17% ownership), with a slight increase from 1,614K shares. They have cut their allocation in CRL by 24.79% over the last quarter.

Clearbridge Investments holds 1,369K shares (2.65% ownership), down from 1,513K shares, reflecting a decrease of 10.57% in their holdings and a 29.70% reduction in allocation.

Vanguard 500 Index Fund Investor Shares owns 1,322K shares (2.56% ownership), which is an increase from 1,293K shares. Their portfolio allocation in CRL also saw a decline of 26.23% over the last quarter.

A Brief Background on Charles River Laboratories International

(Description provided by the company.)

Charles River Laboratories delivers essential products and services that aid pharmaceutical and biotechnology companies, government agencies, and prominent academic institutions worldwide in accelerating research and drug development. Their committed employees focus on enhancing the discovery and development of new therapies for patients in need.

Fintel remains one of the most comprehensive investing research platforms accessible to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data footprint includes fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, insider trading, and more. Our exclusive stock selections leverage advanced quantitative models aimed at maximizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.