Why Nvidia Remains a Strong Buy After Remarkable Stock Growth

Nvidia’s stock has surged nearly 190% in 2023 and nearly 2,830% over the past five years. This impressive performance has made it the second-largest company globally by market capitalization. However, potential investors might be questioning whether the time to buy Nvidia has passed. Here are four reasons why Nvidia stock still appears promising.

1. The AI Boom Is Just Beginning

Nvidia has seen tremendous demand for its graphics processing units (GPUs) as companies invest in AI infrastructure. Despite this surge, experts believe the AI buildout is still in its early stages. Big tech firms and well-funded AI startups, like OpenAI and Elon Musk’s xAI, are heavily investing in AI data centers to train large language models.

Major companies like Alphabet and Meta Platforms have expressed concerns about underinvesting in AI, stating that the main risk isn’t overspending. Similarly, Oracle forecasts no end to AI infrastructure spending in the next five to ten years.

Additionally, Microsoft has seen its finance leases for AI data centers skyrocket to over $108.4 billion in just one year. As AI models develop, they require exponentially more computing power. For instance, Alphabet’s upcoming Llama 4 model will demand up to ten times more computing power than its predecessor, and xAI’s Grok 3 used five times the GPUs compared to Grok 2. This increasing demand positions Nvidia as a critical player in the GPU market.

Image source: Getty Images.

While other companies, such as Advanced Micro Devices and Broadcom, produce GPUs, Nvidia holds an impressive market share of over 80%. This leading position is complemented by its proprietary CUDA software platform, which has become the industry standard for GPU programming. Nvidia’s strategic decision to offer CUDA for free has made it challenging for competitors to gain a significant foothold in the market.

Furthermore, Nvidia is accelerating its chip development cycle from two years to one. This shift allows the company to consistently offer innovative designs, enhancing its technological edge and pricing power. It has recently begun shipping chips using its Blackwell architecture and plans to introduce new chips with its Rubin architecture in 2026.

Currently, Nvidia’s market share appears secure, with no immediate threats to its dominance.

Nvidia’s Attractive Valuation

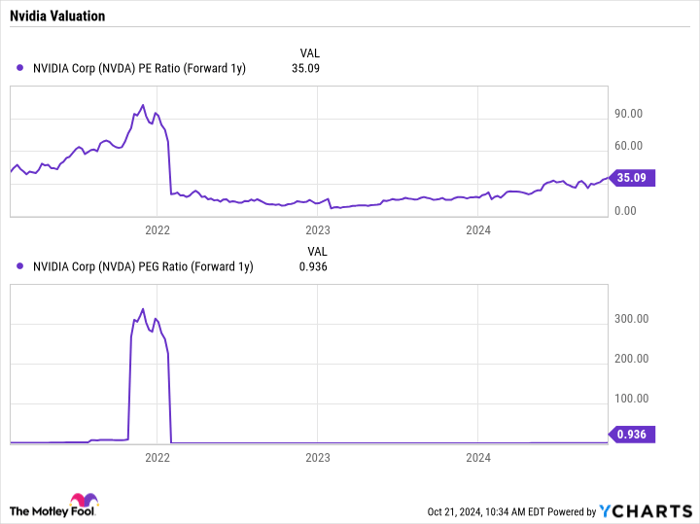

Despite the recent stock price gains, Nvidia remains attractively valued. The company currently trades at a forward price-to-earnings (P/E) ratio of approximately 35 based on 2025 estimates, with a price/earnings-to-growth (PEG) ratio just above 0.9. A PEG under 1 generally indicates that a stock is undervalued, and many growth stocks typically exceed a ratio of 1.

NVDA PE Ratio (Forward 1y) data by YCharts

Nvidia’s strong prospects in AI, combined with its solid market position, support its reasonable valuation.

Large Companies Still Have Room to Grow

Nvidia’s market cap has soared to over $3 trillion, leading some investors to question its potential for future growth. However, history shows that even the largest companies can continue to outperform. In 2014, Apple held a market cap of about $500 million. Fast forward to today, it remains the biggest company globally with a market cap exceeding $3.5 trillion—representing a sevenfold increase in ten years.

Similarly, Microsoft had a market cap of just under $268.56 billion in 2010. By 2020, that figure had risen to $1.2 trillion, nearly a 4.5x increase. Thus, Nvidia’s significant size does not prevent it from achieving further growth, especially with favorable tech trends in its favor.

Final Thoughts on Nvidia’s Investment Potential

If you’ve ever felt like you missed out on investing in successful companies, now may be an opportune time to consider Nvidia. With the ongoing demand for AI infrastructure, a solid market position, and attractive valuation, Nvidia remains a strong contender for future growth in the tech landscape.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.