Citigroup Launches Coverage of FMC with Neutral Outlook

Fintel reports that on October 23, 2024, Citigroup initiated coverage of FMC (NYSE:FMC) with a Neutral recommendation.

Price Target Indicates Potential Gains

As of October 22, 2024, the average one-year price target for FMC is $74.20 per share. Predictions vary from a low of $63.63 to a high of $94.50. This average target suggests a 19.47% increase from FMC’s latest closing price of $62.11 per share.

For more insights, check our leaderboard featuring companies with the largest price target upside.

Revenue and Earnings Projections Look Strong

The anticipated annual revenue for FMC is estimated at $6,332 million, marking a significant growth of 55.03%. Additionally, the projected annual non-GAAP EPS stands at 9.38.

Investor Sentiment and Institutional Activity

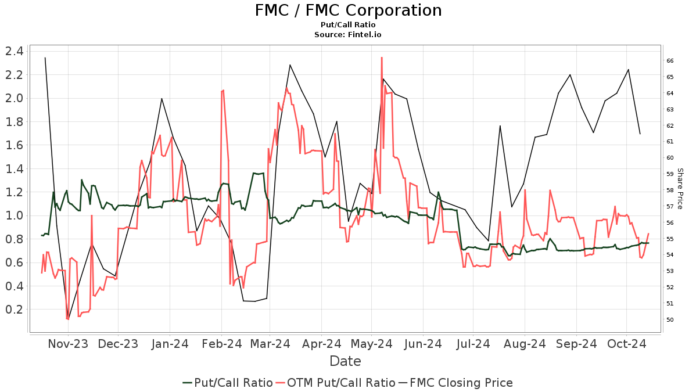

Currently, there are 1,219 funds or institutions reporting positions in FMC. This represents an increase of 7 owners, roughly 0.58%, over the last quarter. The average portfolio weight for all funds dedicated to FMC has climbed to 0.19%, a rise of 7.66%. However, the total shares owned by institutions dipped by 0.91% in the past three months to 137,820K shares.  The current put/call ratio for FMC is 0.76, signaling a bullish outlook among investors.

The current put/call ratio for FMC is 0.76, signaling a bullish outlook among investors.

Wellington Management Group LLP holds 14,728K shares, which amounts to 11.80% ownership in FMC. Their previous filing showed 13,066K shares, reflecting an increase of 11.29%. Over the last quarter, they have raised their portfolio allocation in FMC by 2.62%.

Price T Rowe Associates owns 5,216K shares, or 4.18% of the company. Their earlier report noted they held 5,062K shares, indicating an increase of 2.96%. However, their overall portfolio allocation decreased by 9.10% in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) possesses 3,923K shares, accounting for 3.14% ownership. In comparison to their previous filing of 3,930K shares, this reflects a decrease of 0.16% in ownership, with a decrease in portfolio allocation of 12.29% seen recently.

Ameriprise Financial has 3,729K shares, representing 2.99% ownership, compared to 4,333K shares in their prior filing, denoting a decrease of 16.20% and a dramatic reduction of 86.16% in portfolio allocation this quarter.

THE HARTFORD DIVIDEND AND GROWTH FUND (IHGIX) holds 3,712K shares, accounting for 2.97% ownership. In its last filing, the company noted ownership of 2,990K shares, showing a rise of 19.45%. This fund has increased its allocation in FMC by 14.56% over the last quarter.

Understanding FMC Corporation

FMC Corporation, an agricultural sciences firm, offers innovative solutions for growers globally. The company boasts a comprehensive product portfolio supported by a market-responsive discovery and development pipeline in areas like crop protection, plant health, and pest management. FMC’s lineup includes advanced technologies and products such as Rynaxypyr® and Cyazypyr® based insect controls, various branded herbicides, and fungicides. The company also produces biological solutions like Quartzo® and Presence® bionematicides. FMC Corporation employs approximately 6,400 people worldwide.

Fintel is a prominent platform for investment research, providing data to help individual investors, traders, financial advisors, and small hedge funds make informed decisions. It encompasses a wealth of information, including fundamentals, analyst reports, ownership data, and more. Fintel’s exclusive stock picks are based on advanced, backtested quantitative models aimed at improving profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.