Top Dividend Stocks to Consider During Market Lows

When dividend-paying companies lower their prices, their yields can rise, presenting attractive opportunities for passive income. However, it’s essential to assess the strength of the company behind the dividend. Investing in struggling dividend stocks requires confidence that they can rebound from current challenges.

United Parcel Service (NYSE: UPS), Devon Energy (NYSE: DVN), and Kinder Morgan (NYSE: KMI) might not be at their best, but they have the potential to recover. Kinder Morgan’s stock recently reached an eight-year high, solidifying its position as a value investment.

Here’s why these three dividend stocks are considered worthwhile investments right now, according to Motley Fool experts.

Image source: Getty Images.

United Parcel Service: A Value Stock with Potential

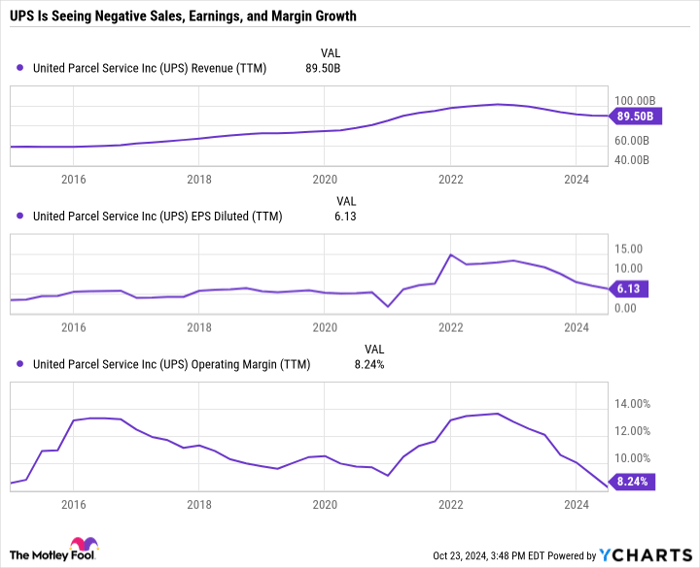

Daniel Foelber (United Parcel Service): UPS currently boasts a price-to-earnings ratio (P/E) of 22.2 and a dividend yield of 4.8%, positioning it as an attractive high-yield stock. However, the company’s recent struggles with sales growth and profitability raise questions about its valuation.

After experiencing significant growth during the pandemic, UPS is now facing challenges reminiscent of its pre-pandemic performance. Investors typically prioritize future success over past achievements, which explains some investor hesitation.

Data by YCharts.

In March, UPS introduced a three-year strategy aimed at boosting delivery volumes in 2024 and improving operating margins in the following years. While early indicators show promising higher delivery volumes in the second quarter, maintaining this growth will be crucial for investor confidence.

The positive aspect is that UPS remains committed to its dividend, although investors should expect modest raises in the near term. With a yield of 4.8%, it remains an appealing option for income-focused investors.

Devon Energy: A Bargain in the Energy Sector

Scott Levine (Devon Energy): For investors seeking consistent income, finding a solid dividend stock can be exhilarating. Devon Energy stands out with a forward dividend yield of 4.9%, and its shares currently trade at just 3.8 times operating cash flow, lower than its five-year average of 4.

Despite a 10% drop in shares this year, Devon’s performance is somewhat overshadowed by the broader market, as the S&P 500 has risen approximately 23% in the same timeframe. Concerns about the company likely stem from a slight decline in energy prices, including a 20% decrease in West Texas Intermediate (WTI) crude over the past year.

It’s important to remember that energy prices fluctuate. Devon Energy is an established player in the exploration and production sector, having navigated downturns in the past. For instance, even with WTI at $70 per barrel, Devon expects a free cash flow yield of 9%, and management plans to return 70% of free cash flow to its investors.

Investors should keep an eye on the upcoming third-quarter earnings presentation on November 5 for further insights and updates, including information about Devon’s recent acquisition of Grayson Mill Energy.

Kinder Morgan: Strong Future in Natural Gas

Lee Samaha (Kinder Morgan): While fresh narratives often dismiss fossil fuels, real-world factors like unpredictable energy prices and geopolitical conflicts suggest that the transition to renewable energy will be slower than anticipated.

This reality has reignited interest in natural gas, a crucial energy source for years to come. Kinder Morgan, specializing in natural gas pipelines and storage, has become more appealing as investors recognize this dynamic.

If predictions about the upcoming presidential election hold, a new administration may increasingly support U.S. energy production, including natural gas. This could reassure Kinder Morgan investors about its long-term sustainability amid the energy transition.

Natural gas will play a significant role in balancing renewable energy sources. Given its current dividend yield of 4.7%, Kinder Morgan is likely to remain an income-generating asset for years ahead.

Considering a $1,000 Investment in UPS?

Before investing in United Parcel Service, weigh the following:

The Motley Fool Stock Advisor analyst team recently selected what they believe are the 10 best stocks to invest in right now, and UPS did not make the cut. These handpicked stocks may offer superior returns in the future.

Reflecting on previous recommendations, if you had invested $1,000 in Nvidia when it was suggested on April 15, 2005, you’d now have $879,935!*

Stock Advisor guides investors with clear strategies for building a successful portfolio, providing regular updates and two new stock picks each month. Since its inception, Stock Advisor has significantly outperformed the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Daniel Foelber, Lee Samaha, and Scott Levine do not have positions in the mentioned stocks. However, the Motley Fool holds positions in and recommends Kinder Morgan, and also recommends United Parcel Service. The Motley Fool’s disclosure policy applies.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.