Analysts Project Upside for Vanguard Mega Cap ETF

In a detailed analysis of ETFs at ETF Channel, we’ve evaluated the trading prices of various holdings against average analyst target prices for the coming year. For the Vanguard Mega Cap ETF (Symbol: MGC), the implied analyst target price is set at $229.08 per unit.

Current Price and Expected Growth

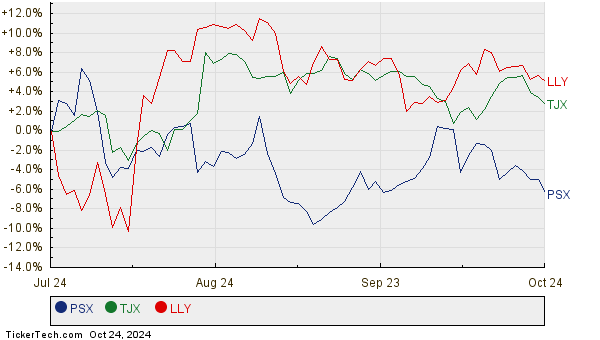

Currently, MGC trades around $208.12 per unit, suggesting a potential upside of 10.07% based on analysts’ projections for its underlying assets. Notably, three of MGC’s holdings demonstrate significant upside potential. These include Phillips 66 (Symbol: PSX), TJX Companies, Inc. (Symbol: TJX), and Lilly (Eli) & Co (Symbol: LLY). Phillips 66, priced recently at $129.12 per share, has an average target price 13.62% higher at $146.71 per share. Similarly, TJX shows 13.34% upside potential from its recent price of $114.22, matching an average target of $129.45. Analysts forecast LLY to reach a target of $1,021.79 per share, 13.12% above its current price of $903.25. Below, you can see a twelve-month price history chart for PSX, TJX, and LLY:

Summary of Analyst Target Prices

Here’s a quick overview of the current target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Mega Cap ETF | MGC | $208.12 | $229.08 | 10.07% |

| Phillips 66 | PSX | $129.12 | $146.71 | 13.62% |

| TJX Companies, Inc. | TJX | $114.22 | $129.45 | 13.34% |

| Lilly (Eli) & Co | LLY | $903.25 | $1,021.79 | 13.12% |

The Bigger Picture

Are analysts right to set these aggressive targets, or are they being unrealistic about future valuations? Recent movements in the market and various industries can impact these price predictions. An elevated target price compared to a stock’s current trading price often signifies optimism, but it might also suggest potential downgrades if the targets do not align with current trends. Investors should consider these angles when evaluating their research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Good Cheap Growth Stocks To Buy

PDSB Options Chain

VIFL Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.