Analysts Predict Growth for SPDR S&P 400 Mid Cap Value ETF

In a recent analysis of ETFs, we assessed how the SPDR S&P 400 Mid Cap Value ETF (Symbol: MDYV) is expected to perform based on the average targets set by analysts for its underlying holdings. The calculated implied target price for MDYV stands at $87.68 per unit.

Current Pricing and Analyst Predictions

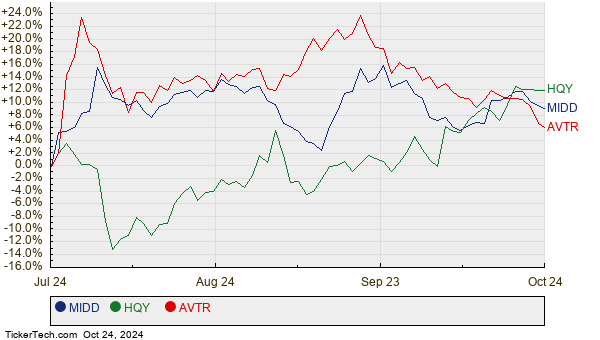

MDYV is currently trading around $80.05 per unit, indicating a potential upside of 9.53% based on analysts’ expectations for its constituent stocks. Three key holdings with significant upside targets include Middleby Corp (Symbol: MIDD), HealthEquity Inc (Symbol: HQY), and Avantor Inc (Symbol: AVTR). MIDD is priced at $136.12/share but has an average target of $161.75/share, suggesting a possible increase of 18.83%. Similarly, HQY’s current price of $87.61 presents an upside of 18.79% to the target price of $104.07/share. Lastly, AVTR, trading at $23.72, has a target of $28.05, showing an upside of 18.28%. Below is a price history chart for these stocks over the past twelve months:

Summary of Analyst Targets

The table below summarizes the current analyst target prices for MDYV and its notable holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 400 Mid Cap Value ETF | MDYV | $80.05 | $87.68 | 9.53% |

| Middleby Corp | MIDD | $136.12 | $161.75 | 18.83% |

| HealthEquity Inc | HQY | $87.61 | $104.07 | 18.79% |

| Avantor Inc | AVTR | $23.72 | $28.05 | 18.28% |

Considerations for Investors

Investors should ask themselves whether analysts are justified in their optimistic forecasts or if these expectations could lead to price target reductions in light of recent developments. High target prices may signal confidence, but they can also reflect outdated assessments. Thorough research and analysis are essential for investors before making informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETF Fund Flows

• ETFs Holding APOL

• CTRA Next Dividend Date

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.