Ameriprise Financial Reports Mixed Earnings for Q3 2024

Ameriprise Financial’s AMP third-quarter 2024 adjusted operating earnings reached $8.83 per share. This figure fell short of the Zacks Consensus Estimate of $8.91 but showed a solid 15% rise compared to the same period last year. When excluding severance costs, adjusted operating earnings stood at $9.02 per share.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Despite a boost in revenue and increased assets under management (AUM) and administration (AUA), the company faced challenges due to rising expenses.

On a GAAP basis, net income was reported at $511 million, or $5.00 per share, down from $872 million or $8.14 per share in the previous year. The projected net income was estimated at $919.1 million.

Revenue Growth Alongside Rising Expenses

For the quarter, adjusted operating total net revenues climbed to $4.35 billion, reflecting an 11% increase year over year and exceeding the Zacks Consensus Estimate of $4.31 billion.

Total GAAP net revenues were reported at $4.4 billion, marking a 12% rise from the prior year.

Adjusted operating expenses were $3.3 billion, also up 11%. Initially, projections for adjusted expenses were set at $3.05 billion. Adjusted total net expenses, excluding special items like severance, reached $3.19 billion.

The AUM and AUA surged by 22% year over year, now totaling $1.51 trillion, which was spurred by strong client net inflows and favorable market conditions. The forecasted figure for this metric was $1.41 trillion.

During this quarter, Ameriprise repurchased 1.3 million shares at a cost of $563 million.

Evaluating Ameriprise’s Outlook

The increase in expenses, especially due to investments in technology, could continue to affect Ameriprise’s profitability. However, the company is likely to see significant revenue growth thanks to its solid AUM and recent business restructuring efforts.

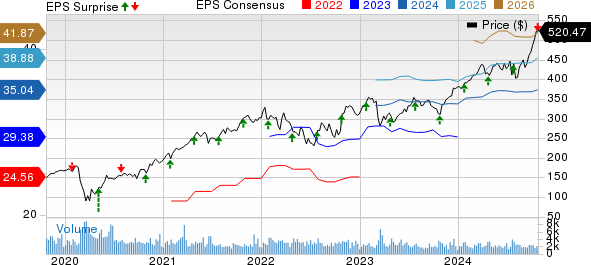

Ameriprise Financial, Inc. Price, Consensus and EPS Surprise

Ameriprise Financial, Inc. price-consensus-eps-surprise-chart | Ameriprise Financial, Inc. Quote

AMP currently holds a Zacks Rank #2 (Buy). You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance Insights from Ameriprise’s Peers

BlackRock’s BLK third-quarter 2024 adjusted earnings were $11.46 per share, significantly exceeding the Zacks Consensus Estimate of $10.34. This performance reflects a 5% increase compared to the prior year.

Results for BLK were fueled by rising revenues and non-operating income. Additionally, AUM grew to an impressive $11.45 trillion, driven by strong net inflows and market gains, although increased expenses posed some challenges.

Invesco’s IVZ third-quarter 2024 adjusted earnings reached 44 cents per share, meeting expectations. This represents a 25.7% increase from the same quarter last year.

IVZ’s positive results were primarily due to lower adjusted expenses and a rise in adjusted net revenues alongside increased AUM driven by good client inflows.

5 Stocks Set to Double

This report highlights five stocks selected by Zacks experts as potential candidates to gain 100% or more in 2024. Though not every recommendation may succeed, past suggestions have seen remarkable growth rates of +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks included are currently overlooked by Wall Street, making this an opportune moment to consider investing early.

Today, Explore These 5 Potential Home Runs >>

If you want to keep up with the latest recommendations from Zacks Investment Research, download your copy of 5 Stocks Set to Double today.

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.