At ETF Channel, we analyzed the iShares Core S&P Mid-Cap ETF (Symbol: IJH) by comparing its underlying stocks’ trading prices to the average 12-month analyst target prices. Our findings show an implied target price for IJH of $69.29 per unit based on its holdings.

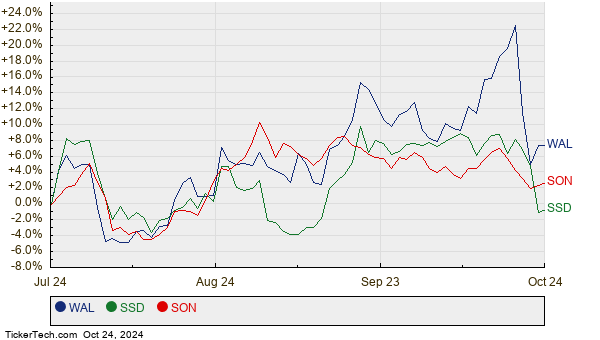

Currently priced at around $62.36 per unit, IJH is viewed by analysts to have an 11.12% potential upside according to their projections. Notably, three holdings within IJH stand out due to their significant upside potential: Western Alliance Bancorporation (Symbol: WAL), Simpson Manufacturing Co., Inc. (Symbol: SSD), and Sonoco Products Co. (Symbol: SON). Despite WAL’s recent price of $82.34 per share, analysts expect a target of $96.38, indicating a 17.05% increase. Likewise, SSD, trading at $176.48, has a target price of $206.50—offering a potential 17.01% upside. Sonoco Products is also set to rise, with analysts projecting its value could reach $61.60 from the current price of $52.69, a 16.91% increase. Below is a price history chart comparing WAL, SSD, and SON:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P Mid-Cap ETF | IJH | $62.36 | $69.29 | 11.12% |

| Western Alliance Bancorporation | WAL | $82.34 | $96.38 | 17.05% |

| Simpson Manufacturing Co., Inc. | SSD | $176.48 | $206.50 | 17.01% |

| Sonoco Products Co. | SON | $52.69 | $61.60 | 16.91% |

These target prices prompt questions: Are analysts accurately predicting future stock performance, or could they be overly optimistic? A high target relative to the current trading price signals confidence but could also lead to adjustments if market conditions change. Investors should consider these aspects before making decisions.

![]() 10 ETFs With Highest Potential Upside to Analyst Targets »

10 ETFs With Highest Potential Upside to Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding ODDS

• PFPT Videos

• ETFs Holding BP

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.