Snap Inc. Gears Up for Q3 2024 Earnings Report

Snap SNAP will announce its third-quarter 2024 results on October 29.

For this quarter, Snap anticipates total revenues between $1.335 billion and $1.375 billion, suggesting a year-over-year increase of 12-16%. The company projects adjusted EBITDA in the range of $70 million to $100 million.

Currently, the Zacks Consensus Estimate for revenues stands at $1.35 billion, which indicates a 13.9% rise compared to the same quarter last year.

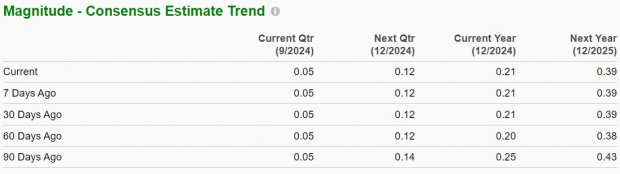

Over the past 30 days, the consensus for earnings has steady at 5 cents per share.

Explore the latest earnings estimates and surprises on the Zacks Earnings Calendar.

Snapshot of SNAP’s Estimates

Image Source: Zacks Investment Research

Review of Past Earnings Surprises

Snap has exceeded the Zacks Consensus Estimate in three of the last four quarters, with one match, yielding an average earnings surprise of 81.07%.

Snap Inc. Price and Earnings Surprise

Snap Inc. price-eps-surprise | Snap Inc. Quote

Insights on Earnings Expectations

Our model suggests that it is unclear if Snap will exceed earnings expectations this quarter. Generally, a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 (Hold) boosts the chances for an earnings surprise. Currently, SNAP holds an Earnings ESP of 0.00% and a Zacks Rank of 3.

Key Factors Influencing Results

Increasing usage of Snapchat is benefiting Snap. The app’s rising popularity among the Gen Z demographic (ages 13 to 24) appears to be contributing to growth in Daily Active Users (DAUs), thus broadening its advertiser base.

For this quarter, the company anticipates DAUs to reach 441 million. In the second quarter, Snapchat saw an 8.8% year-over-year increase in DAUs to 432 million, adding 10 million users compared to the previous quarter.

The model currently estimates third-quarter global DAUs to be around 441 million, reflecting an 8.7% increase from last year. The breakdown for DAUs is approximately 102 million in North America, 99 million in Europe, and 240 million in the rest of the world.

Snap has also made strides in promoting Augmented Reality (AR) Lenses and Snap Map features. Recently, it introduced the fifth generation of Spectacles, its standalone AR glasses, powered by Snap OS, which enhances user interaction through innovative options.

The Snapchat+ subscription service reached over 11 million subscribers in the second quarter, helped by features like Creator Collab Campaigns and Snap Promote. For the current quarter, the estimated Average Revenue Per User (ARPU) sits at $3.05, marking a 4% increase from last year’s results.

Significant steps have been taken to diversify revenue streams via Snapchat+, ARES, and sponsored AR advertising.

The launch of My AI, a chatbot powered by ChatGPT integrated into Snapchat, exemplifies Snap’s focus on integrating advanced AI technology into its platform. This, along with enhanced AR features and tools for content creation driven by AI, will likely impact user retention positively.

During the reviewed quarter, Snap has introduced an AI Lens, allowing Snapchat+ users to enhance their content creatively. My AI can help interpret intricate signage or translate foreign menus, among other tasks.

Stock Performance and Valuation Overview

Snap’s stock price has dropped 39.8% year-to-date, underperforming the Zacks Computer and Technology sector, which has seen a return of 25.3%. Investors are evaluating whether to hold or sell shares during this turbulent time. Despite promising AI and AR innovations, Snap faces substantial challenges, including weak advertising spending and fierce competition from tech giants like Meta Platforms META and Alphabet GOOGL. The company’s ability to monetize its AI features, especially in advertising, is essential for financial success.

Performance Compared to Sector and Peers

Image Source: Zacks Investment Research

Snap’s forward 12-month price-to-sales ratio stands at 2.81, higher than the Zacks Internet – Software industry average of 2.67, reflecting high growth expectations but also indicating greater risk.

Valuation and Profitability Concerns

Image Source: Zacks Investment Research

This valuation highlights the urgency for Snap to effectively monetize its user base while navigating an increasingly competitive landscape.

Investment Insights: Evaluating Risks and Opportunities

Snap maintains a strong foothold among younger audiences, boasting a 75% market penetration rate among those aged 13 to 34 in developed nations. Its leadership in AR technology paves the way for enhanced engagement and enterprise solutions. Although the competition from TikTok and Meta remains strong, Snap’s recent emphasis on cost control and AI-enabled content recommendations shows potential for improved margins. Nevertheless, its growth in advertising revenue faces challenges from fluctuating economic conditions. Investments in AR commerce and premium subscriptions could help broaden revenue avenues, although the efficiency of these monetization strategies still trails that of its rivals. Recent innovations in AI could foster increased user interaction and create added value for advertisers.

Conclusion

Snap’s year-to-date decline of 39.8% presents a complex landscape leading up to its third-quarter earnings. The promising developments in AR and cost management are noteworthy, but uncertainties in advertising spending, influenced by varying economic signals, could affect results. The recent investment in AI may not lead to significant revenue changes in the short term. Investors might find it beneficial to wait for clearer signals of sustained advertiser demand and improved monetization strategies before making strategic moves. A chance to reassess after earning results may provide better investment opportunities.

Discover 5 Stocks with High Growth Potential

These stocks have been identified by a Zacks expert as having the potential to increase by 100% or more in 2024. Although not every selection will be a winner, past picks have yielded average gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently under the radar on Wall Street, presenting an excellent opportunity to get in early.

Today, explore these 5 potential winners >>

Interested in the latest recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” for free.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

You can read this article on Zacks.com here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.