Target Stock Shows Potential Amid Price Drop

Target Corporation (TGT), a key player in the retail market, is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 14.4X. This places it at a notable discount compared to the average of 29.36X in the Retail – Discount Store sector. Additionally, TGT is trading below its one-year median P/E of 15.31, indicating that the stock is potentially undervalued compared to both its competitors and its historical performance.

Valuation Signals Opportunity for TGT

Image Source: Zacks Investment Research

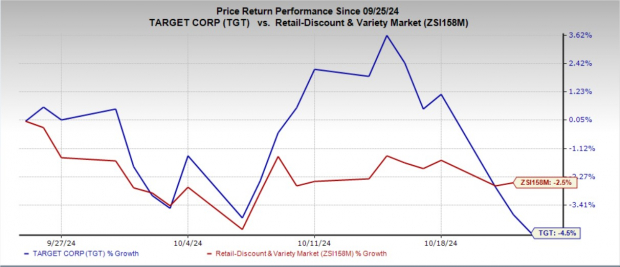

Despite the attractive valuation, Target’s stock has seen a 4.5% decline over the last month. This drop may indicate broader market challenges or specific issues unique to Target’s operations.

Recent Performance Analysis: TGT Stock

Image Source: Zacks Investment Research

A lower P/E ratio suggests potential value in Target’s stock. Conducting a detailed analysis is vital for deciding whether to buy, hold, or sell shares. Investors should look closely at Target’s fundamental strengths and strategic plans. Should the company effectively address its challenges and reveal a clear path for growth, the current lower valuation could serve as an appealing entry point for buyers.

As of the latest trading session, Target’s stock closed at $148.05, marking 18.6% below its 52-week peak of $181.86 hit on April 1. This context invites a deeper look into TGT’s future prospects and outlines investment strategies.

Target’s Strategy for Success in Retail

Target is leveraging its strong brand recognition and diverse product range, along with growing e-commerce capabilities, to enhance its competitive edge. The company is focused on innovation and efficient operations, setting a strong foundation for future growth.

By merging traditional retail locations with a robust online presence, Target aims to improve shopper convenience and accessibility. Initiatives like same-day delivery, curbside pickup, and personalized online services are crucial for competing effectively against giants like Amazon (AMZN), Walmart (WMT), and Dollar General (DG).

The diversity of Target’s product offerings—from private labels to well-known national brands—makes it a convenient shopping destination. The retailer adapts to shifting consumer preferences by broadening its range of essential and discretionary products. Innovations in popular categories such as home goods and groceries demonstrate Target’s proactive strategy to cater to customer interests.

In today’s economic climate, Target is appealing to budget-conscious shoppers through strategic pricing. The recent price cuts on thousands of items could drive sales. Moreover, the Target Circle loyalty program plays an increasingly important role in fostering customer loyalty and engagement.

With a commitment to operational best practices, including effective inventory management, Target is enhancing its attractiveness for potential investors. The operating margins improved to 6.4% in the second quarter of fiscal 2024, suggesting the company is on track to reach pre-pandemic profitability levels. Coupled with investments in AI technology and an emphasis on customer experience, Target is positioning itself as a viable long-term investment option.

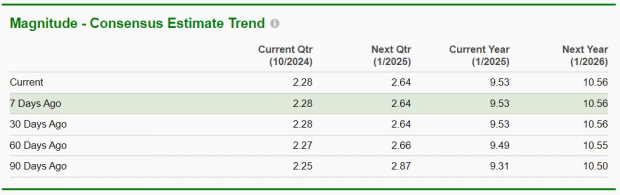

Analyst Sentiment on TGT Shares

Wall Street analysts remain optimistic about Target stock, as they have revised their earnings per share (EPS) estimates upward. In the last two months, estimates for the current fiscal year increased by 0.4% to $9.53, while projections for the next year rose by 0.1% to $10.56 per share. These consensus figures imply year-over-year growth rates of 6.6% and 10.8%, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Investment Conclusion: TGT Stock – A Buy, Hold, or Sell?

Although Target has recently experienced a decline in stock price, its solid growth strategy and innovative customer engagement initiatives suggest a positive outlook. The company’s ability to adapt to evolving consumer preferences, alongside improvements in operating margins, strengthens its recovery prospects.

With analysts bolstering their earnings expectations, this could be an excellent opportunity for investors to take a closer look at TGT stock. Those already invested might choose to maintain their holdings, while newcomers may find the current valuation attractive, marking a strategic opportunity to invest in this Zacks Rank #2 (Buy) stock.

5 Stocks Set to Double

Each stock featured was selected by a Zacks expert as a top contender for a significant gain of +100% or more in 2024. While not every recommendation leads to a win, past selections have yielded impressive increases of +143.0%, +175.9%, +498.3%, and +673.0%.

This report includes stocks that are largely off the radar on Wall Street, offering a unique chance to get in early.

Today, Explore These 5 Potential Home Runs >>

Want the latest insights from Zacks Investment Research? You can download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.