Upcoming Earnings Report: Alphabet GOOGL Poised for Q3 Growth

Alphabet (GOOGL) is scheduled to announce its third-quarter results for 2024 on Oct. 29. The Zacks Consensus Estimate anticipates earnings of $1.83 per share, reflecting an 18.06% increase from the same quarter last year, unchanged over the past month. Revenue expectations stand at $72.83 billion, which represents a 13.71% year-over-year growth.

Alphabet has demonstrated a consistent track record of exceeding earnings estimates, boasting an average surprise of 9.6% over the past four quarters.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Alphabet Inc.’s Price and Earnings Performance

Alphabet Inc. price-eps-surprise | Alphabet Inc. Quote

As we approach the earnings announcement, let’s consider key factors influencing the results:

Generative AI Growth Expected to Enhance Q3 Earnings

Alphabet is likely to benefit from the strength of its Android operating system and robust growth in its search and cloud sectors due to advancements in generative AI. The release of its powerful AI model, Gemini, is anticipated to have driven significant demand.

Google’s Vertex AI supports developers in creating applications using these new AI capabilities, likely expanding its customer base. Additionally, the introduction of Gemini Code Assist, aimed at enterprise needs, is an important addition to its offerings.

These innovations should contribute positively to revenue in the upcoming quarter.

AI Integration Boosts Google Search Traffic

Innovative AI techniques have played a crucial role in increasing traffic to Google’s search engine, which remains a major revenue stream. The Search Generative Experience (SGE), designed to make search results more intuitive, is expected to have enhanced user engagement.

Mobile search capabilities, along with effective advertising strategies powered by foundational research models and LLMs, continue to strengthen Alphabet’s position. YouTube Shorts is also expected to maintain its growth momentum through improved relationships with content creators.

The Expanding Cloud Business: A Major Growth Driver

Alphabet has seen significant growth in the cloud-computing market, solidifying its position as the third-largest provider, following Amazon’s AMZN AWS and Microsoft’s MSFT Azure. The adoption of Google Cloud and Google Workspace has been impactful, supported by investments in infrastructure and AI tools.

Enhancements in its cloud offerings leveraging Gen AI are expected to further drive growth in this segment.

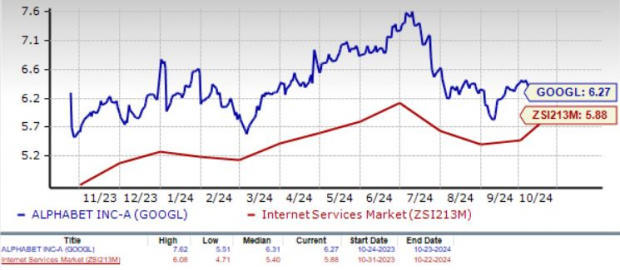

GOOGL Performance Compared to Sector Peers

Despite a 16.5% appreciation in its stock price year-to-date (YTD), Alphabet’s performance has lagged behind the Zacks Internet Services industry, which is up 17.2%, and the Zacks Computer & Technology sector at 27.1%. Among peers in the “Magnificent 7,” which includes notable names like Apple AAPL and NVIDIA, Alphabet has seen less impressive gains. Only Microsoft and Tesla have fallen short compared to GOOGL’s YTD performance.

Concerns related to regulatory scrutiny and allegations of unfair practices involving Android and Google Search have affected investor confidence, contributing to the stock lagging behind competitors.

Currently, GOOGL shares are considered overvalued, holding a Value Score of C. The forward 12-month Price/Sales ratio stands at 6.27X compared to the industry average of 5.88X.

Price/Sales Comparison

Image Source: Zacks Investment Research

Despite regulatory challenges and intense competition, Alphabet’s growth in generative AI presents an opportunity for future expansion. Its leading market share in search remains a significant asset.

With a Zacks Rank #2 (Buy), GOOGL shares may still hold potential for investors. You can access Zacks’ complete list of top-ranked stocks here.

5 Stocks Poised for Significant Growth

These stocks have been selected by Zacks experts, each with the potential to double in value in 2024. Some previous picks have returned remarkable profits, including +143.0%, +175.9%, and even +673.0%.

Most stocks highlighted are under the radar on Wall Street, providing a unique opportunity for early investments. Explore the 5 Potential Home Runs now.

Download Zacks’ report today for the latest recommendations.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.