Amazon’s Satellite Ambition: Project Kuiper Aims to Bridge Digital Divide

Amazon’s (NASDAQ:AMZN) Project Kuiper is on a mission to deliver broadband internet access to areas lacking connectivity. This ambitious project plans to deploy thousands of satellites into low Earth orbit (LEO), which lies up to 2,000 kilometers above our planet.

From Concept to Reality: Progress on Project Kuiper

Launched in 2018, Project Kuiper didn’t gain much attention from investors until Amazon highlighted its potential impact on earnings during the second quarter of 2024. Following successful tests of two prototype satellites in 2023, the company kicked off full-scale production this year, with plans to begin satellite launches in early 2025.

Cost Challenges Ahead

However, as this significant milestone approaches, Bank of America analyst Justin Post, who is part of the top 1% of Wall Street stock experts, raises concerns regarding costs. How much will it take to get Project Kuiper off the ground? Post estimates that establishing the satellite network could cost Amazon around $16 billion, mainly due to the expenses associated with launching the satellites. In 2024 and 2025, he predicts Amazon will invest between $1 billion and $3.5 billion on this project. There is also the possibility that the company could begin “capitalizing costs” by the second half of next year, which may lower operating expenses to approximately $1.8 billion in 2025. Post notes, “Assuming a 5-year replacement cycle and 60% gross margins, we estimate Kuiper needs ~7 million subscribers to break even on annual replenishment costs.”

A Vast Market with Significant Hurdles

With 2.6 billion people worldwide lacking broadband access, Project Kuiper has a sizable total addressable market (TAM). According to Fortune Business Insights, global revenue from such services could reach $26 billion by 2032. Nevertheless, challenges abound, including the limited disposable income of potential users, existing competitors like Starlink, and substantial upfront costs alongside high ongoing expenses. Nevertheless, Amazon’s extensive logistics network, which uses autonomous vehicles, trucks, drones, and delivery robots, stands to gain from a reliable and connected internet service. However, Post cautions that despite the potential, losses from Project Kuiper are expected to increase, and given Amazon’s current market capitalization of over $1.8 trillion, it may take years before the project contributes to any increase in Amazon’s market cap.

Stock Outlook and Analyst Ratings

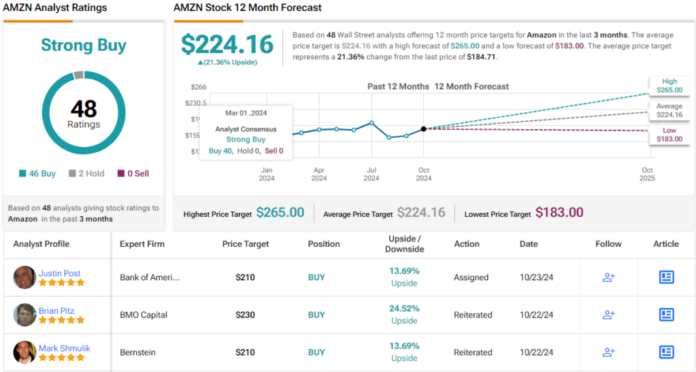

Despite these challenges, Post maintains a “Buy” rating on AMZN shares, proposing a price target of $210, which suggests a potential upside of around 14% from current levels. Among analysts covering Amazon, two of Post’s colleagues are currently holding off with “Hold” ratings, while the other 46 reiterate positive views, resulting in a “Strong Buy” consensus for the stock. Analysts foresee a 19% increase over the next 12 months, with the average target set at $224.16.

For valuable stock ideas that are trading at favorable valuations, visit TipRanks’ Best Stocks to Buy, a tool that collects equity insights from TipRanks.

Disclaimer: The opinions expressed in this article represent the analysis of the featured analyst and are intended for informational purposes. It is crucial to conduct your own analysis before making any investment decisions.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.