Keybanc Adjusts Outlook for Verizon Communications Amid Changing Investor Sentiment

Fintel reports that on October 24, 2024, Keybanc downgraded its rating for Verizon Communications (SNSE:VZ) from Overweight to Sector Weight.

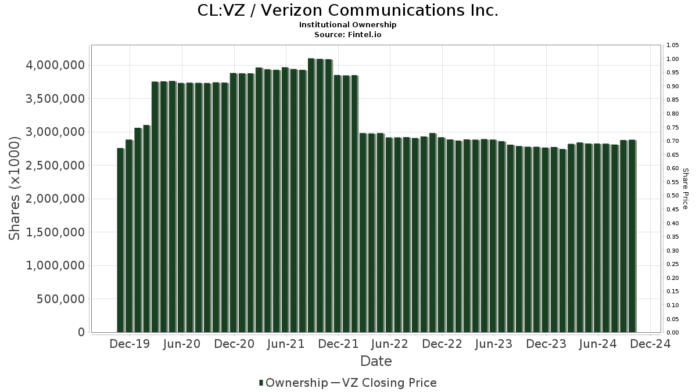

Increasing Institutional Interest in Verizon

Currently, there are 4,052 funds or institutions with positions in Verizon Communications. This marks an increase of 23 owners, or 0.57%, over the last quarter. The average portfolio weight of all funds invested in VZ is 0.51%, which represents a growth of 2.20%. In total, institutional shares rose by 5.68% in the past three months, reaching 2,894,507K shares.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now holds 119,744K shares, accounting for 2.84% of the company’s ownership. This is an increase from 118,972K shares reported previously, showing a growth of 0.64%. However, VTSMX has also reduced its portfolio allocation in VZ by 3.81% over the last quarter.

Similarly, the Vanguard 500 Index Fund Investor Shares (VFINX) increased its holdings from 105,952K to 108,034K shares, reflecting a 1.93% increase. Yet, the firm lowered its investment allocation in VZ by 5.13% during the same period.

Charles Schwab Investment Management reported ownership of 95,337K shares, a slight decrease from 95,708K shares, marking a decline of 0.39%. They also cut their portfolio allocation in VZ significantly by 31.91% in the last quarter.

Geode Capital Management raised its holdings from 90,890K to 93,743K shares, demonstrating an increase of 3.04%. Still, the firm decreased its allocation to VZ by a substantial 49.77% over the same timeframe.

Norges Bank made a notable entry, acquiring 55,461K shares, which accounts for 1.32% of the company. This marks a complete ownership shift, as they previously reported owning 0K shares, translating to a 100.00% increase.

Fintel stands out as a comprehensive investing research platform tailored for individual investors, traders, financial advisors, and small hedge funds.

Our platform features an extensive database that includes fundamentals, analyst reports, ownership information, fund sentiment, insider trading, options flows, and unique quantitative stock picks for enhanced profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.