UBS Boosts Cullinan Therapeutics with a Strong Buy Rating

Fintel reports that on October 24, 2024, UBS initiated coverage of Cullinan Therapeutics (NasdaqGS:CGEM) with a Buy recommendation.

Analyst Price Forecast Indicates Significant Growth

As of October 22, 2024, the average one-year price target for Cullinan Therapeutics is $33.37/share. This represents a potential increase of 110.41% from its most recent closing price of $15.86/share. The forecasts for the stock range from a low of $28.28 to a high of $42.00.

Discover more about companies with promising price targets.

Projected Revenue and Earnings Analysis

Cullinan Therapeutics is projected to generate annual revenue of $28 million, showing no significant percentage increase reported. The projected annual non-GAAP earnings per share (EPS) stands at -3.16.

Institutional Investor Sentiment on Cullinan

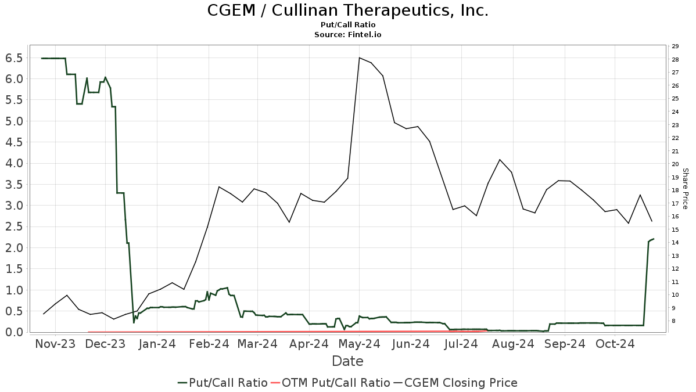

Currently, 315 funds or institutions are reporting positions in Cullinan Therapeutics, reflecting an increase of 39, or 14.13%, from the previous quarter. The average portfolio weight for all funds dedicated to CGEM is 0.23%, a rise of 17.51%. In the last three months, total shares owned by institutions surged by 58.53%, totaling 66,488K shares.  The put/call ratio for CGEM currently sits at 2.21, indicating a bearish outlook.

The put/call ratio for CGEM currently sits at 2.21, indicating a bearish outlook.

MPM Oncology Impact Management retains 7,648K shares, accounting for 13.19% ownership, unchanged from the last quarter.

BVF increased its holdings significantly, now owning 5,751K shares, which constitutes 9.92% ownership—a rise from 3,197K shares, marking an increase of 44.41%. Their portfolio allocation in CGEM also jumped by 87.70% over the same period.

Deerfield Management Company holds 3,280K shares, representing 5.66% ownership, reflecting a jump from 1,139K shares—a notable increase of 65.29%. Their portfolio allocation in CGEM soared by 182.00% in the last quarter.

Franklin Resources now holds 2,444K shares, down from 2,697K shares, indicating a decrease of 10.34% and an 84.94% drop in portfolio allocation in CGEM over the last quarter.

Finally, Adage Capital Partners Gp, L.l.c. holds 2,233K shares, marking a 57.45% increase from 950K shares, along with a 135.97% rise in portfolio allocation in CGEM.

Cullinan Therapeutics: An Overview

(This description is provided by the company.)

Cullinan Management is a biopharmaceutical firm focused on creating a diverse pipeline of targeted oncology and immuno-oncology therapies with transformative potential for cancer patients. The company aims to develop therapeutic candidates that are uncorrelated across multiple dimensions, emphasizing assets with novel technologies, unique mechanisms, advanced development stages compared to competitors, or a combination of these qualities.

Fintel is a leading investment research platform tailored for individual investors, traders, financial advisors, and small hedge funds. Our comprehensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for enhanced profitability.

Click to learn more.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.