Michael Burry’s Contrarian Bet: Big Moves in Chinese Tech Stocks

Michael Burry, known for his role in The Big Short, is back in the spotlight for his bold investments in Chinese technology. Following a history of market predictions, he’s placed a significant portion of his portfolio in this unpopular sector.

Examining Burry’s Recent Investments

As of the end of the second quarter, approximately 46% of Burry’s investments at Scion Capital Management are concentrated in three Chinese tech giant stocks. Alibaba (NYSE: BABA) constitutes 21.3% of his portfolio, followed by Baidu (NASDAQ: BIDU) at 12.4%, and JD.com (NASDAQ: JD) at 12.3%. Burry began acquiring these stocks in Q4 2022.

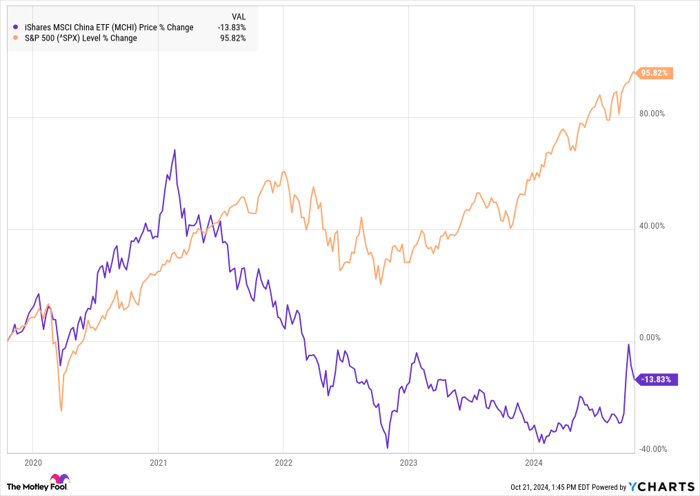

The overall perception of Chinese stocks has been quite negative in recent years, with the iShares MSCI China ETF lagging behind the performance of the S&P 500, as illustrated in the chart below.

MCHI data by YCharts

Recent gains in Chinese stocks have been linked to Beijing loosening lending rates and restrictions, suggesting that Burry’s strategy may be beginning to bear fruit.

David Tepper Joins the Trend

Michael Burry is not the only investor eyeing Chinese stocks. Billionaire fund manager David Tepper, founder of Appaloosa Management, has also increased his holdings in this sector. Tepper’s primary investment is again in Alibaba, which accounts for 12.2% of his portfolio, with Pinduoduo’s parent company PDD Holdings (NASDAQ: PDD) forming another 4.2%. He has also invested in Baidu, the Kraneshares CSI China ETF (NYSEMKT: KWEB), JD.com, and KE Holdings (NYSE: BEKE), which together constitute 6.6% of his investments.

In total, nearly 25% of Tepper’s holdings are in Chinese stocks. His interest in the sector began in Q2 2022.

The Case for Investing in Chinese Stocks

Many top investors believe that U.S. stocks might be overvalued, as evidenced by Warren Buffett’s recent selling strategy. However, Chinese stocks remain attractively priced. The iShares MSCI China ETF, featuring Tencent and Alibaba as its leading assets, exhibits a price-to-earnings (P/E) ratio of 11.6 compared to the iShares Core S&P 500 ETF‘s P/E ratio of 29.4.

In light of the rising popularity of artificial intelligence stocks such as Nvidia, the S&P 500’s value has increased, prompting figures like Burry and Tepper to seek better prospects in Chinese investments. Given the current valuation differential, even a small uptick in growth could result in significant outperformance relative to the S&P 500.

Why Caution is Still Required

Despite these opportunities, the performance of Chinese stocks has been disappointing for many investors recently. Their underlying challenges, such as a sluggish economy and reduced consumer spending, persist without much sign of improvement. Lower interest rates alone might not be sufficient to spur growth.

It’s questionable whether companies like Alibaba and JD.com can achieve their pre-pandemic growth trajectories. Furthermore, restrictions on U.S. chip exports could hinder China’s ability to compete in emerging technologies, including AI. Investors remain wary of potential regulatory crackdowns similar to the 2020 halt of Ant Financial’s IPO.

While Chinese stocks may appear undervalued, they carry inherent risks as well.

Is PDD Holdings a Strong Investment?

For cautious investors, it may be wise to hold off on most Chinese stocks until a clearer economic recovery is evident. However, PDD Holdings, the company behind Pinduoduo and Temu, shows potential for growth despite the weak financial backdrop. It has consistently outperformed Alibaba and JD.com and continues to expand in international markets, enhancing its revenue prospects.

Trading at a reasonable valuation, PDD Holdings may just be the best contender to thrive in this challenging environment.

Should You Invest $1,000 in PDD Holdings Now?

Audit these developments carefully before committing to PDD Holdings. Notably, the Motley Fool Stock Advisor analysts recently selected what they believe are the 10 best investments right now, and PDD Holdings did not make the list. The chosen ten stocks are predicted to yield significant returns in the near future.

The Motley Fool Stock Advisor has successfully guided numerous investors and has outperformed the S&P 500 since 2002.

See the 10 recommended stocks now »

*Stock Advisor returns as of October 21, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Baidu, JD.com, Nvidia, and Tencent. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.