“`html

Microsoft Braces for Earnings Report Amid Robust Growth Expectations

Microsoft (MSFT) is reporting its first-quarter fiscal 2025 results on October 30.

The Zacks Consensus Estimate anticipates revenues of $64.41 billion, reflecting a 14% increase compared to the same quarter last year.

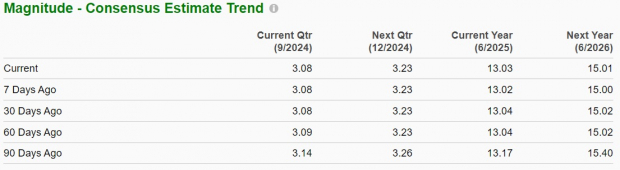

Meanwhile, the consensus estimate for earnings has been adjusted down by a penny to $3.08 per share, indicating a 3% year-over-year growth.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Examining Earnings Surprise History

In its most recent quarter, Microsoft delivered an earnings surprise of 1.72%. Over the last four quarters, the company has consistently beaten the Zacks Consensus Estimate, achieving an average earnings surprise of 6.34%.

Microsoft’s Price and Earnings Surprise Analysis

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Earnings Whispers

The current model does not guarantee an earnings beat for Microsoft this quarter. A favorable Earnings ESP coupled with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically suggests a higher chance of an earnings beat, which is not the case this time. At present, Microsoft holds an Earnings ESP of -0.74% and a Zacks Rank #3.

Key Factors Influencing Upcoming Results

The upcoming first quarter results are expected to showcase strong performance, primarily bolstered by the Intelligent Cloud and Productivity and Business Processes segments. The company’s emphasis on cloud services, especially Azure and the Office 365 suite, is projected to significantly enhance revenue growth.

In the Intelligent Cloud segment, Microsoft expects revenues between $28.6 billion and $28.9 billion. Our estimate stands at $28.69 billion, representing an 18.3% increase from the same period last year. Furthermore, Azure is forecasted to experience growth ranging from 28% to 29% at constant currency, serving as a cornerstone of Microsoft’s AI-driven strategy.

Another integral aspect of Microsoft’s growth is Teams, its communication platform for businesses, which continues to broaden its user base and features, effectively going head-to-head with competitors such as Zoom, particularly in the age of hybrid work arrangements.

The Productivity and Business Processes segment is expected to generate revenues between $20.3 billion and $20.6 billion, with our estimate around $20.34 billion, indicating a 9.4% year-over-year rise. This is driven by solid performance across various product lines, though traditional Office products are seeing a decline as the market shifts towards cloud solutions.

As for the company’s More Personal Computing segment, Microsoft projects revenues between $14.9 billion and $15.3 billion.

Despite slow personal computer demand, revenues from Windows are somewhat supported by gradual traction in commercial products and cloud services. According to the International Data Corporation’s preliminary results for Q3 2024, global PC shipments totaled 68.8 million units, marking a 2.4% decline from last year. Factors such as increased costs and inventory adjustments contributed to a slower sales cycle.

In the gaming sector, Microsoft anticipates revenue growth in the low to mid-30% range, significantly aided by the acquisition of Activision. Xbox content and services revenue is projected to grow by low to mid-50%.

Evaluating Price Performance and Valuation

Year-to-date, shares of MSFT have increased by 12.9%, underperforming compared to the broader Zacks Computer & Technology sector, which has grown by 25.3%. Competing firms like DELL, HPE, and AAPL have witnessed gains of 57.6%, 14.3%, and 19.8%, respectively.

MSFT’s Valuation Compared to Sector and Peers

Image Source: Zacks Investment Research

Looking at valuation metrics, Microsoft’s forward 12-month price-to-sales (P/S) ratio is 10.91X, significantly surpassing the Zacks Computer – Software industry average of 7.71X and the median of 10.17X, indicating a stretched valuation.

MSFT’s Elevated P/S Ratio Signals Potential Caution

Image Source: Zacks Investment Research

Final Thoughts on Investment Potential

Microsoft stands out as a strong investment opportunity due to its leading position in cloud computing (Azure) and productivity software (Office 365), which together fuel sustained revenue expansion. The company’s commitment to integrating AI into its services also adds to its competitive edge.

“`

Microsoft’s Strategic Edge in a Competitive Tech Landscape

A Diverse Portfolio Provides Stability

Microsoft Corporation (MSFT) stands out as a leader in technological innovation. Its varied business segments, including gaming with Xbox and professional networking through LinkedIn, offer stability and multiple paths for growth.

Despite these opportunities, challenges loom large. Intense competition in the cloud services sector from rivals like Amazon and Google is a significant concern. Additionally, the cyclical nature of enterprise IT spending, along with increasing regulatory scrutiny regarding market dominance and data privacy, adds to the risks. Even so, Microsoft’s robust balance sheet, steady cash flow, and history of returning capital to shareholders through dividends and buybacks position it as a strong option for investors who value both growth and stability in the technology sector.

Outlook and Expectations

Looking ahead, Microsoft is poised for substantial growth in the fiscal first quarter of 2025, primarily driven by its productivity and collaboration offerings. This comes despite its premium valuation and fierce competition in the cloud space. The company’s strategic focus on cloud services, artificial intelligence (AI) integration, and innovative product developments safeguards its competitive edge. Holding onto Microsoft shares appears wise at this moment, although investors may want to wait for a more favorable buying opportunity.

7 Best Stocks for the Next 30 Days

Experts have recently identified seven elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are expected to be “Most Likely for Early Price Pops.”

Since 1988, selected stocks from this list have significantly outperformed the market, achieving an average annual gain of +23.7%. Therefore, these handpicked stocks are worth your immediate attention.

Want updated picks from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.