Utilities Stocks Struggle as Financial Sector Follows Suit

In afternoon trading on Friday, Utilities stocks are the worst performing sector, showing a 1.1% loss. Within the sector, DTE Energy Co (Symbol: DTE) and Edison International (Symbol: EIX) are two large stocks that are lagging, showing a loss of 2.0% and 1.7%, respectively. Among utilities ETFs, one ETF following the sector is the Utilities Select Sector SPDR ETF (Symbol: XLU), which is down 1.2% on the day, and up 29.87% year-to-date. DTE Energy Co, meanwhile, is up 18.14% year-to-date, and Edison International is up 21.05% year-to-date. Combined, DTE and EIX make up approximately 4.8% of the underlying holdings of XLU.

Financial Sector Takes a Hit

The Financial sector is the next worst performer, reflecting a 1.0% loss. Notable declines among major Financial stocks include Principal Financial Group Inc (Symbol: PFG) and Hartford Financial Services Group Inc. (Symbol: HIG), with losses of 7.4% and 6.8%, respectively. The Financial Select Sector SPDR ETF (XLF), which tracks this sector, is down 1.2% during midday trading but remains up 25.20% for the year. Additionally, Principal Financial Group Inc has gained 8.17% year-to-date, while Hartford Financial Services Group Inc. has risen significantly with a 41.47% year-to-date increase. Together, PFG and HIG comprise approximately 0.8% of the underlying holdings of XLF.

Sector Performance Overview

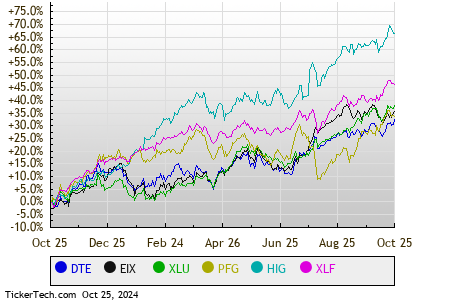

For a clearer picture of market performance, here’s a comparative chart showcasing the stock price performance of various sectors over the last twelve months, with symbols identified by color-coded legend:

Below is a snapshot of how the S&P 500 components within different sectors are performing in afternoon trading on Friday. Among them, only one sector is in the positive territory while the rest are declining.

| Sector | % Change |

|---|---|

| Technology & Communications | +0.5% |

| Consumer Products | 0.0% |

| Services | -0.1% |

| Energy | -0.1% |

| Industrial | -0.2% |

| Healthcare | -0.6% |

| Materials | -0.9% |

| Financial | -1.0% |

| Utilities | -1.1% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Funds Holding HF

• Institutional Holders of Garmin

• Funds Holding SDVY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.