Following the Wealthy: Recent Stock Picks from Billionaire Investors

Many investors turn to billionaires for potential stock recommendations, hoping to replicate their success in the market. However, it’s important to recognize that billionaire investors often have different objectives compared to regular investors aiming for long-term wealth accumulation. This disparity necessitates additional research for everyday investors to ensure that the stocks align with their investment strategies.

In this article, we explore three specific stocks that have recently attracted billionaire investors.

Amazon (NASDAQ: AMZN)

Amazon (NASDAQ: AMZN) is widely recognized among investors across all financial backgrounds. It dominates both the online retail and cloud computing sectors, making it a popular choice for consumers and investors alike.

Even though its online sales have seen limited growth, Amazon has thrived through subscriptions, services for third-party sellers, and advertising revenue. Additionally, its AWS division, which is thriving due to the rise of cloud computing and AI, is responsible for a substantial portion of the company’s operating income.

In the first half of 2024, net sales increased by only 11% year-over-year, yet profits surged by 141% during the same period, reflecting a strong recovery from prior year weaknesses.

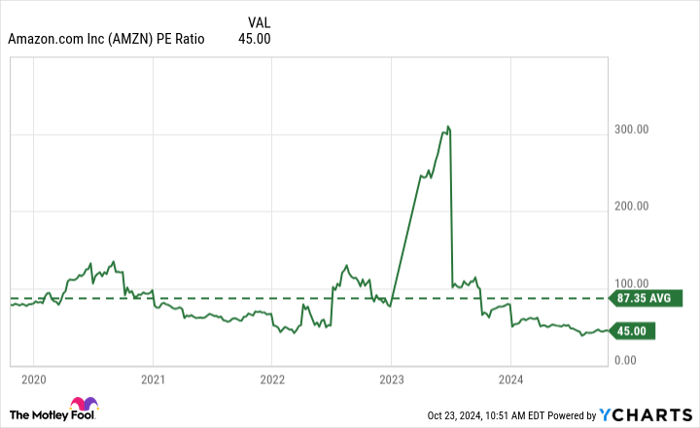

While a 45 P/E ratio may seem high, it’s still significantly lower than the stock’s five-year average of 87, possibly attracting several billionaires like Ken Griffin, Ray Dalio, and Paul Tudor Jones to expand their positions in the second quarter of 2024. With various business operations and $89 billion in cash reserves, Amazon stands out as one of the safer individual stocks, likely making it appealing for average investors.

Invesco QQQ Trust (NASDAQ: QQQ)

Another significant investment choice by billionaires is the Invesco QQQ Trust (NASDAQ: QQQ), an exchange-traded fund (ETF) that tracks the 100 non-financial stocks in the Nasdaq-100 index. This ETF garners interest from a broad spectrum of investors due to its diverse holdings.

Although it consists of 100 stocks, the fund’s weightings can shift. Currently, Apple is the top holding at nearly 9%, and the top ten stocks, predominantly in tech, account for over 50% of its assets.

The Invesco QQQ Trust has delivered strong returns, achieving a 37% increase over the past year, which closely aligns with the S&P 500. Over the last decade, it has gained 436%, nearly doubling the S&P 500’s performance.

This impressive performance has attracted billionaire investors like Cliff Asness and Steven Cohen, who likely see it as a balanced investment between safety and significant growth. Given its diversification and robust returns, the ETF represents a sound investment choice for many investors.

Super Micro Computer (NASDAQ: SMCI)

Super Micro Computer (NASDAQ: SMCI) has rapidly gained attention as its collaboration with Nvidia led to soaring demand for its servers.

The stock’s volatility has increased markedly, as it surged past $120 per share in March, only to face a sell-off following a negative report from Hindenburg Research in late August, alongside the announcement of a delay in its 10-K filing with the SEC. In this context, it’s important to remember that short-sellers profit when the stocks decline, creating an incentive for spreading negative sentiment.

Billionaire Israel Englander, through Millennium Management, purchased shares of Super Micro in the second quarter prior to the short-seller’s report. With a modest P/E ratio of 24 and analysts predicting 51% profit growth for fiscal 2025, some risk-tolerant investors may still consider buying now, despite potential lingering accounting concerns.

Nevertheless, due to the unknowns surrounding the company, Super Micro may be better suited for speculative investors, while more conservative investors might want to steer clear.

Lessons from Billionaire Investing

While billionaires possess impressive stock picking skills, it is crucial for average investors to conduct their own research before emulating these choices. Billionaires did not build their fortunes by making poor investment decisions, but no investor is correct every time.

A Second Chance at Winning Stocks

Do you ever feel like you missed the opportunity to invest in top-performing stocks? There’s still time to get involved.

Occasionally, our team of analysts identifies companies ready to take off, and they issue a *“Double Down” stock* recommendation. If you think you missed your shot, now might be the perfect moment to invest before it’s too late, with numbers that speak volumes:

- Amazon: If you invested $1,000 when first recommended in 2010, you’d have $20,991!

- Apple: A $1,000 investment made when recommended in 2008 would be worth $43,618!

- Netflix: Investing $1,000 at the recommendation in 2004 would have turned into $406,922!

Currently, we are unveiling “Double Down” alerts for three remarkable companies, which might not come around again soon.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Will Healy holds positions in Super Micro Computer. The Motley Fool has positions in and recommends Amazon, Apple, and Nvidia. The Motley Fool follows a disclosure policy.

The views expressed belong to the author and do not necessarily represent those of Nasdaq, Inc.