Navigating Investment Choices in a Rising Market

The S&P 500 index has soared, confirming its presence in a bull market early this year and going on to reach new records multiple times. The benchmark today is heading for a 22% annual gain, led by investors’ optimism about a lower interest rate environment and excitement about the hot growth area of artificial intelligence (AI). Tech players involved in this fast-growing field have skyrocketed, and many still may have much more room to run over the long term.

All of this sounds great, but it’s left many stocks trading at record highs — and certain valuations looking pretty expensive. This may prompt you to wonder if you really should buy stocks today at a record high. At times like these, investing expert and billionaire Warren Buffett offers valuable insights.

As the chairman of Berkshire Hathaway, Buffett has guided the portfolio to a compounded annual gain of nearly 20% over 58 years, significantly surpassing the S&P 500’s 10% growth. He has experienced various market conditions and consistently emerged successful.

Let’s take a closer look at Buffett’s recent actions in a booming stock market to see if there are strategies we should consider adopting.

Image source: The Motley Fool.

Understanding the Current Market Valuations

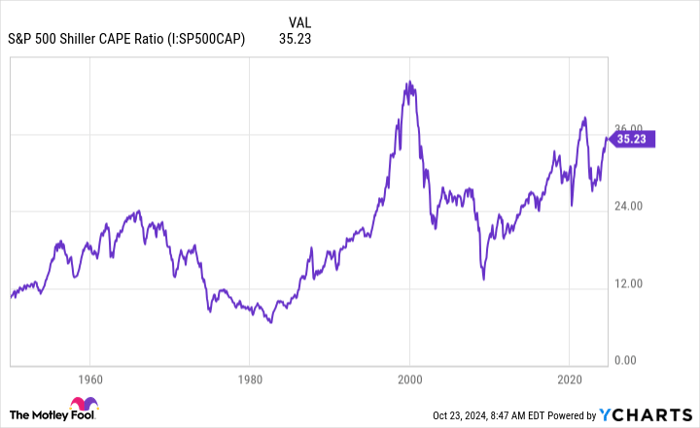

A brief look at market valuations reveals a significant concern. The S&P 500 Shiller CAPE ratio, a measure that accounts for earnings over a decade adjusted for economic cycles, has increased recently. This marks only the third occasion since the late 1950s that the ratio has surpassed the level of 35.

S&P 500 Shiller CAPE Ratio data by YCharts

In light of this, it is notable that Buffett has been more of a seller than a buyer in recent times. For instance, during the second quarter, he and his team at Berkshire Hathaway sold shares of nine different companies, including one of his favorites, Apple (NASDAQ: AAPL). More recently, they have continued to sell shares of Bank of America.

This selling trend must be seen in context. Buffett also purchased two new stocks in the second quarter, namely Ulta Beauty and Heico. Additionally, he added to long-held positions like Occidental Petroleum and maintained over 20 other investments.

We may not know his exact reasoning for each transaction, but some patterns are evident. Buffett indicated at the Berkshire Hathaway shareholder meeting in May that he sold some of his Apple shares to lock in profits while capital gains tax rates remain favorable, anticipating future increases.

Buffett’s Confidence in Apple

Importantly, Apple continues to be Buffett’s largest holding by value, suggesting that his decision to sell does not reflect a loss of confidence in the company. If he believes capital gains tax rates might rise, it also makes sense to secure some profits in Bank of America, another long-term investment.

Looking at Buffett’s recent acquisitions reveals that not all stocks are overpriced, even in a climbing S&P 500. For instance, Ulta is currently trading at 15 times forward earnings estimates, a decrease from 24 times earlier this year.

Buffett is well-known for taking advantage of lower market prices, but he doesn’t stop investing when stocks seem costly; he seeks quality stocks at reasonable prices in any market context. His actions in the second quarter illustrate this strategy, showing that even as the market indices rose, he still found opportunities to expand his portfolio.

This approach reinforces the idea that, like Buffett, one should continue investing in today’s market, no matter the conditions. Through careful analysis of individual companies, investors can discover bargains or reasonably priced stocks at any time. Sticking to a disciplined investing strategy year after year may lead to long-term gains.

Is Now a Good Time to Invest in Apple?

Before deciding to invest in Apple, keep the following in mind:

The Motley Fool Stock Advisor analyst team has recently identified what they consider the 10 best stocks to buy right now… and Apple wasn’t included. The selected stocks have high potential for substantial returns.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $860,447!*

Stock Advisor offers a straightforward guide for achieving investment success, including advice on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Ulta Beauty. The Motley Fool recommends Heico and Occidental Petroleum. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.