Benchmark Sees Potential in Lyft: Coverage Initiated with Hold Recommendation

Fintel reports that on October 25, 2024, Benchmark started coverage of Lyft (NasdaqGS:LYFT) with a Hold rating.

Analyst Price Forecast Indicates 14.12% Upside Potential

As of October 22, 2024, analysts estimate a one-year price target for Lyft at $15.30 per share. Predictions vary, with estimates ranging from $10.10 to a high of $27.30. This average target suggests a 14.12% increase from the most recent closing price of $13.41 per share.

Explore our leaderboard of companies showing significant price target upside.

Lyft’s projected annual revenue stands at $5,658 million, reflecting a growth of 11.05%. Additionally, the projected annual non-GAAP EPS is set at 1.60.

Analyzing Fund Sentiment Towards Lyft

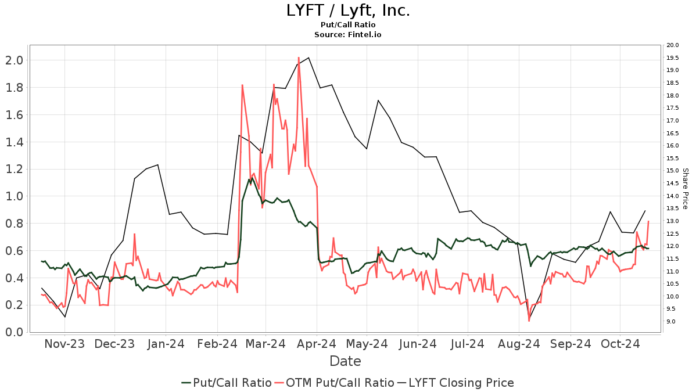

Currently, 739 institutional funds hold positions in Lyft, an increase of 52 (7.57%) from the previous quarter. The average portfolio weight for these funds dedicated to LYFT is 0.18%, demonstrating a rise of 15.10%. Over the last three months, institutional ownership has grown by 2.67%, totaling 346,916K shares.  The put/call ratio for LYFT is reported at 0.54, indicating a bullish sentiment among investors.

The put/call ratio for LYFT is reported at 0.54, indicating a bullish sentiment among investors.

Fidelity Blue Chip Growth Fund (FBGRX) holds 21,534K shares, making up 5.36% of Lyft. This represents a decline of 0.93% from the earlier 21,735K shares, alongside a significant 31.57% reduction in its portfolio allocation.

Meanwhile, UBS Asset Management Americas owns 17,972K shares (4.47% of the company) but has seen a 10.30% decrease from previously owning 19,824K shares, reducing its allocation by 46.69% in the last quarter.

Vanguard Total Stock Market Index Fund (VTSMX) holds 10,458K shares, which is 2.60% ownership, down from 10,563K shares—a drop of 1.00%, marking a 29.85% decline in allocation. In contrast, Qube Research & Technologies saw an increase, holding 10,280K shares and growing its stake substantially by 171.14% from the 2,754K shares reported previously.

Ameriprise Financial has also increased its holdings to 8,824K shares (2.20% ownership), rising from 5,686K shares, which is a 35.56% increase in its portfolio allocation.

Background on Lyft

(This information is provided by the company.)

Founded in 2012, Lyft has grown to become one of the largest transportation networks in the United States and Canada. As society gradually shifts away from car ownership towards transportation-as-a-service models, Lyft positions itself at the forefront of this change. The company’s app integrates a wide range of transportation options, including rideshare, bikes, scooters, car rentals, and public transit. Driven by its mission, Lyft aims to enhance the quality of life for individuals through superior transportation solutions.

Fintel is a leading investing research platform designed for individual investors, traders, financial advisors, and small hedge funds.

Featuring global data, Fintel provides insights on fundamentals, analyst reports, ownership behaviors, fund sentiment, options activity, and much more. Our exclusive stock picks utilize advanced, backtested quantitative models aimed at boosting profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.