Lyft Receives ‘Hold’ Rating as Institutional Support Grows

On October 25, 2024, Benchmark initiated coverage of Lyft (LSE:0A2O) with a Hold recommendation.

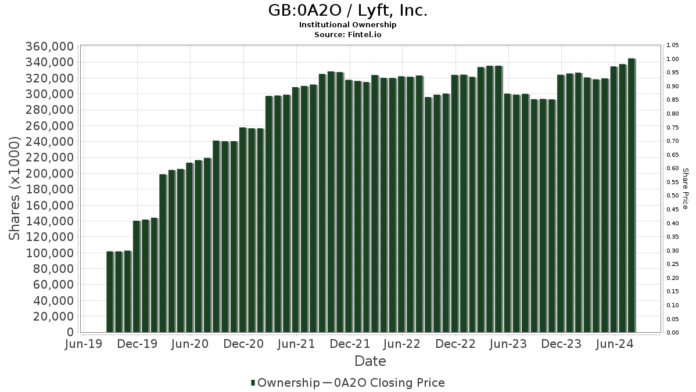

Increasing Institutional Interest

A total of 738 funds or institutions now hold positions in Lyft, marking an increase of 52 investors (7.58%) from the previous quarter. The average portfolio weight of all funds dedicated to 0A2O stands at 0.18%, reflecting a 15.10% rise. Over the last three months, total institutional shares increased by 6.39%, reaching 350,767K shares.

Fidelity Blue Chip Growth Fund (FBGRX) owns 21,534K shares, equivalent to 5.36% of Lyft. This is a slight decline, as their prior report showed ownership of 21,735K shares, which reflects a decrease of 0.93%. Their portfolio allocation in 0A2O has decreased by 31.57% over the last quarter.

UBS Asset Management Americas holds 17,972K shares, corresponding to 4.47% ownership. Previously, they owned 19,824K shares, marking a decrease of 10.30%. Their portfolio allocation in 0A2O has dropped by 46.69% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) now holds 10,458K shares, which is 2.60% ownership. This represents a reduction from 10,563K shares in the prior filing, indicating a decrease of 1.00% with a 29.85% cut in their portfolio allocation for 0A2O.

Meanwhile, Qube Research & Technologies has increased its holdings to 10,280K shares, representing 2.56% ownership, a significant rise from their previous 2,754K shares—an increase of 73.21%. Their portfolio allocation in 0A2O has surged by 171.14% this past quarter.

Ameriprise Financial reports holding 8,824K shares for a 2.20% stake, up from 5,686K shares. This represents an increase of 35.56%, with an 11.33% growth in their 0A2O portfolio allocation.

Fintel serves as a comprehensive research platform for individual investors, traders, financial advisors, and smaller hedge funds. Our data encompasses fundamentals, analyst reports, ownership data, fund sentiment, as well as metrics on insider trading and unusual options trades.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.