NVE Corporation Reports Mixed Q2 Results as Revenue Streams Shift

NVE Corporation has revealed its financial performance for the second quarter of fiscal 2025, highlighting a shift towards contract research and development (R&D) amid challenges in product sales. Despite facing unfavorable market conditions, the company is strategically focusing on partnerships and R&D to enhance its revenue base.

Although operating income faced pressure from rising expenses linked to innovation, NVE’s improved gross margin indicates effective cost management. Their strong cash position and commitment to dividends signal a focus on long-term stability and shareholder value.

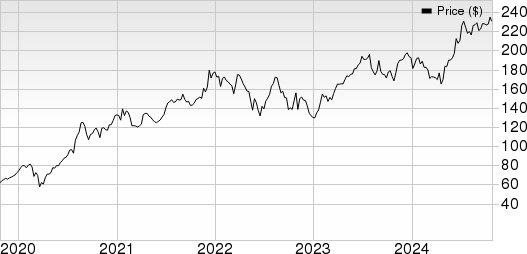

NVE Corporation Market Performance Overview

NVE Corporation market overview chart | NVE Corporation Quote

Fiscal Q2 Financial Results

NVE Corp’s earnings per diluted share fell by 15% to 83 cents compared to 98 cents from the same quarter last year, driven by a challenging economic landscape.

Total revenues also showed a decline of 5%, coming in at $6.76 million, down from $7.13 million over the same quarter last year.

The downturn in product sales due to weakened demand in core markets was partially balanced by a notable increase in contract R&D revenues, highlighting a shift towards varied income sources.

Diverging Trends: Product Sales vs Contract R&D

In its latest financial report, NVE Corp’s two main segments—product sales and contract R&D—exhibited contrasting trends.

Product sales, the company’s main source of income, saw a 14% decrease to $6.1 million in Q2 fiscal 2025, down from $7.1 million the previous year. This downturn reflects reduced demand in NVE’s target sectors.

Conversely, revenues from contract R&D skyrocketed by an extraordinary 3,950%, jumping from $16,154 to $654,257. This remarkable growth indicates a successful pivot towards innovative partnerships.

Profitability Overview

Despite mixed performance results in Q2 of fiscal 2025, NVE Corp’s profitability metrics show some improvements. Gross profit rose by 5% to $5.81 million, resulting in a gross margin of approximately 86%, up from 78% a year earlier. This improvement was largely due to a reduction in sales costs.

However, operating income dipped by 5% year on year to $4.40 million, affected by increased expenditures in R&D and administrative costs. Notably, R&D spending climbed by 24% to $0.85 million as the company invests in advanced spintronic technology.

Net income fell 15% to $4.03 million from $4.72 million in the same quarter last year. The net margin, estimated around 60%, dropped from 66%. This decline is tied to rising expenses alongside a 5% drop in total income, indicating that while NVE maintained a solid gross margin, higher operational costs and lower revenues impacted overall profitability.

Cost Analysis Insights

Costs of sales decreased by 41% to $0.95 million compared to $1.6 million in the prior year, attributed to streamlined production and reduced manufacturing expenses in light of lower product sales.

On the other hand, operating expenses rose, primarily due to a 24% increase in R&D costs, reaching $0.85 million, which reflects NVE’s augmented focus on innovation and contract research.

Moreover, selling, general, and administrative expenses climbed by 31% year over year to $0.57 million, indicative of heightened operational expenditures in sales and corporate management.

Cash and Investment Position

As of September 30, 2024, NVE’s cash and cash equivalents were recorded at $3.1 million, a decline from $10.3 million as of March 31, 2024. Meanwhile, short-term marketable securities rose significantly to $19.8 million, up from $11.9 million in March 2024, reflecting a strategic move towards higher-yield short-term investments.

Importantly, NVE Corp holds no debt, maintaining financial flexibility in an ever-changing market.

Recent Company Actions

NVE’s board announced a quarterly dividend of $1 per share, indicating confidence in its ability to generate cash despite declining revenues. The dividend is set to be paid on November 29, 2024, to shareholders on record by November 4, 2024, aligning with its commitment to return value to its investors.

Featured Stock Recommendations

Research analysts from Zacks have identified top stock picks, highlighting one that could potentially double in value. Among numerous options, Director of Research Sheraz Mian has spotlighted a single stock projected for significant growth, targeting millennial and Gen Z consumers, having generated nearly $1 billion last quarter.

A recent price pullback provides an attractive entry point. Although not all picks may succeed, past recommendations like Nano-X Imaging, which gained +129.6% in just over nine months, set a promising precedent.

Free: Discover Our Top Stock Pick and Four Alternatives

NVE Corporation (NVEC): Free Stock Analysis Report

For more details on NVE’s financials, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.