Stifel Lowers Rating for Kraft Heinz: What This Means for Investors

On October 25, 2024, Stifel adjusted its outlook for Kraft Heinz (BRSE:KHC) from Buy to Hold.

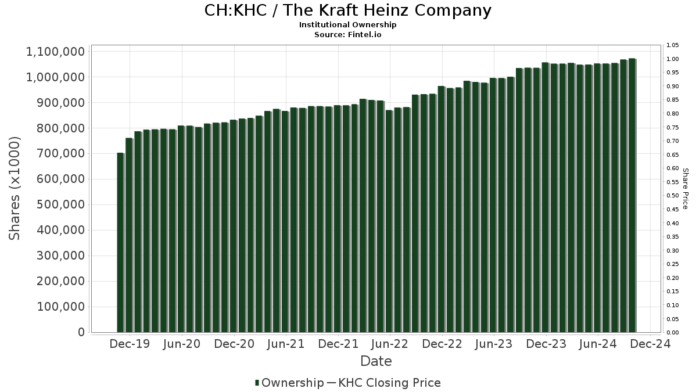

Rising Fund Activity in Kraft Heinz

Currently, there are 2,014 funds or institutions that hold positions in Kraft Heinz, reflecting an increase of 43 owners, or 2.18%, in the past quarter. The average portfolio weight allocated to KHC by these funds is now 0.25%, which is an increase of 4.73%. Additionally, institutional ownership has grown by 3.08% over the last three months, reaching a total of 1,071,693K shares owned.

Berkshire Hathaway remains the most significant shareholder, holding 325,635K shares, which accounts for 26.93% ownership. This figure has not changed in the last quarter.

Bank Of America holds 29,368K shares, representing 2.43% ownership, but has decreased its allocation from 29,938K shares, marking a decline of 1.94%. In total, the firm reduced its portfolio allocation in KHC by 79.92% over the last quarter.

Invesco, on the other hand, has increased its holdings. It now owns 25,006K shares, up from 24,409K shares, which accounts for a 2.39% rise. However, Invesco also reduced its portfolio allocation in KHC by 92.24% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 24,929K shares (2.06% ownership), a slight increase from the previous 24,850K shares, attributed to a growth of 0.32%. Nonetheless, it too has decreased its allocation in KHC by 14.82% over the last quarter.

Lastly, the Invesco QQQ Trust, Series 1 has boosted its holdings from 22,739K to 23,387K shares, showing a growth of 2.77%. Despite this increase, the firm has shrunk its portfolio allocation in KHC by 19.16% during the last quarter.

Fintel provides one of the most robust investing research tools available to individual investors, financial advisors, small hedge funds, and traders.

We offer comprehensive data on fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, and other valuable insights. Our exclusive stock picks, based on advanced and tested quantitative models, aim to enhance profitability.

Click to Learn More

This article was originally published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.