Keybanc Lowers Apple’s Stock Outlook: What Investors Should Know

Keybanc Changes Outlook for Apple

On October 25, 2024, Keybanc announced a downgrade of its outlook for Apple (WSE:AAPL) from Sector Weight to Underweight.

Fund Sentiment Towards Apple

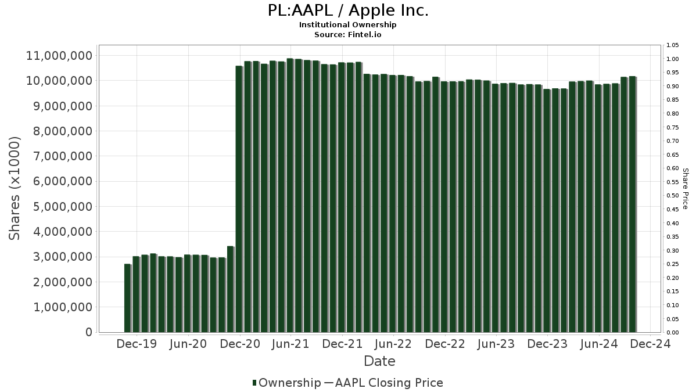

A total of 7,110 funds or institutions are currently invested in Apple, marking an increase of 217 owners, or 3.15%, over the last quarter. The average portfolio weight dedicated to AAPL across all funds rose to 3.62%, an increase of 12.91%. In the past three months, institutional ownership has seen a 6.45% rise, reaching 10,272,177K shares.

Actions of Major Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 460,208K shares, which is 3.03% of Apple. In its last report, it listed 461,127K shares, a decrease of 0.20%. However, VTSMX has increased its allocation to AAPL by 19.20% in the previous quarter.

Berkshire Hathaway now owns 400,000K shares, representing a 2.63% stake. In its previous filing, Berkshire reported 789,368K shares, showing a significant decrease of 97.34%. Its allocation to AAPL dropped by 26.26% in the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) owns 369,946K shares, making up 2.43% of the company. The latest filing showed an increase from 365,796K shares, an improvement of 1.12%. The fund has raised its allocation to AAPL by 17.59% over the past three months.

Geode Capital Management holds a 2.06% stake with 313,374K shares compared to 307,721K shares previously, reflecting an increase of 1.80%. Their portfolio weighting in AAPL has risen by 18.67% lately.

Price T Rowe Associates has increased its holdings from 206,972K to 228,489K shares, or 1.50% ownership, representing an increase of 9.42%. Its allocation in AAPL has jumped by 32.38% in the last quarter.

Fintel offers in-depth investing research for individual investors, traders, financial advisors, and small hedge funds. Our platform provides extensive data, including fundamentals, analyst insight, ownership statistics, and fund sentiment, alongside insights on insider trading and options activity.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.