Rivian’s Rocky Road: Can It Overcome Recent Challenges?

Investors have mixed feelings about Rivian (NASDAQ: RIVN), a young electric vehicle (EV) maker with a dynamic track record of highs and lows. Some are optimistic about its potential amidst the growing shift toward electric vehicles, while others worry about its ability to compete in a tough, cash-intensive sector. Recent issues in production and delivery raise questions: is it time to steer clear of Rivian?

Not yet – here’s why investors might want to hold on.

Challenges in Deliveries

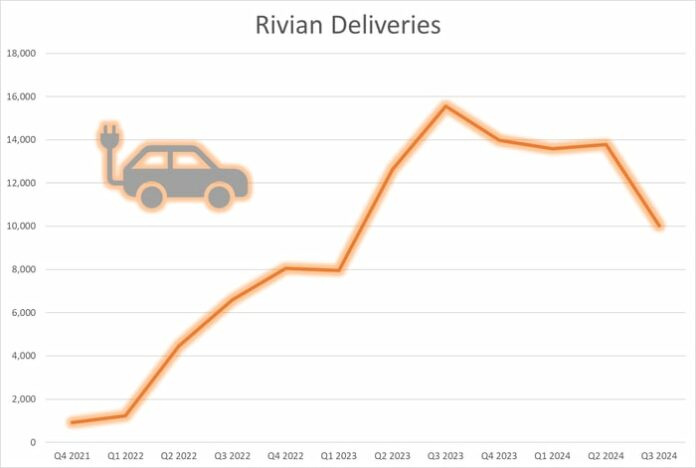

The recent troubles Rivian has faced need some context. In the third quarter, the company delivered only 10,018 vehicles, which marked a significant 36% drop from the same period last year. Additionally, Rivian lowered its full-year production forecast from 57,000 vehicles to a range of 47,000 to 49,000 units. While it was expected that deliveries would plateau in 2024, seeing the figures can be jarring.

Data source: Rivian production and deliveries releases. Graphic by author.

These production issues stemmed from a shortage of a component shared between the company’s R1T, R1S, and RCV models. However, it’s worth noting several reasons why Rivian still holds potential for growth.

Emerging Opportunities

Rivian is launching new initiatives that may eventually contribute to its financial success. One noteworthy development is its new pre-owned sales program for R1T and R1S vehicles, aimed at customers looking for more affordable options. With these vehicles coming off lease, Rivian can serve a wider market while offering factory warranties and inspections to attract buyers.

Additionally, the company is expanding its RCV line. Initially exclusive to Amazon, Rivian has now opened this platform to other customers. This change could yield significant sales growth, provided that new clients begin to engage with the product in 2025. Securing even a few large orders would positively impact the company’s bottom line.

Moreover, investors are advised to note the joint venture with Volkswagen, which plans to invest up to $5 billion into Rivian. This partnership aims to develop advanced software-defined vehicle platforms, potentially allowing Rivian to sell its technology to companies looking to create their own software solutions.

Looking ahead, Rivian has an exciting product pipeline, including the much-anticipated R2 crossover, smaller R3, and R3X models. The R2 is set to launch in early 2026, with a starting price under $50,000, making it accessible compared to the current R1 offerings, which start in the lower $70,000 range. Expanding the product lineup could improve Rivian’s market reach, drive sales, and help reduce financial losses.

What This Means for Investors

Seeing deliveries decline can be unsettling for investors, particularly as demand might also be an issue. However, it’s crucial to remember that Rivian is still in its early stages. Many of its strategies for growth are still in development. There’s no immediate reason to sell just yet, but investors should be prepared for price fluctuations, particularly until the R2 model debuts.

Should You Invest $1,000 in Rivian Automotive Now?

Before considering an investment in Rivian Automotive, it’s important to evaluate options:

The Motley Fool Stock Advisor team has highlighted their picks for the 10 best stocks right now, and Rivian is not among them. The chosen stocks could deliver strong returns going forward.

For context, when Nvidia was selected on April 15, 2005, a $1,000 investment at that time would be worth approximately $867,372 today!*

Stock Advisor provides a structured approach for investors, offering guidance on portfolio development, regular updates, and two new stock picks each month. The Stock Advisor service has significantly outperformed the S&P 500 since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.