Nuclear Energy: A New Era on the Horizon

Countries and companies are rekindling interest in nuclear power as demand for electricity surges, driven by the rise of electric vehicles and artificial intelligence. Despite years of opposition from environmental groups, the recognition of nuclear energy’s low carbon emissions marks a pivotal shift in perspective.

Electric Vehicles and Data Demand Fueling Growth

The call for nuclear energy is primarily fueled by two significant trends. First, electric cars now account for 19% of new automotive sales in the U.S., a stark increase from nearly zero ten years ago. This shift reflects a major transformation in the automotive market, as it moves from gasoline to electric power, leading to increased demand for electricity.

Second, the data center market is expanding rapidly, particularly due to the burgeoning need for artificial intelligence. By 2030, data centers are projected to consume 9.1% of all U.S. electricity. Companies like Microsoft and Amazon, the largest data center operators, are securing long-term agreements with electric utilities to develop or rekindle nuclear facilities as they seek stable power sources beyond intermittent wind and solar energy.

NuScale Power: Aiming for Change

Enter NuScale Power Corp, which is looking to innovate the nuclear landscape with its small modular reactors (SMRs). Unlike traditional nuclear plants that require significant investment and time, SMRs are designed to be smaller and constructed through a repeatable process. This could lead to lower costs and quicker deployment.

If NuScale can position itself as a frontrunner in SMR technology, it could face a nearly infinite demand for its product as more companies seek reliable power sources.

Challenges Ahead for NuScale Power

The company is also facing significant cash burn, with a reported negative free cash flow of $170 million over the past year. With only $130 million in cash reserves, NuScale may run out of funds within the next year, needing to secure additional financing through stock offerings or debt to sustain operations until its reactors can be marketed.

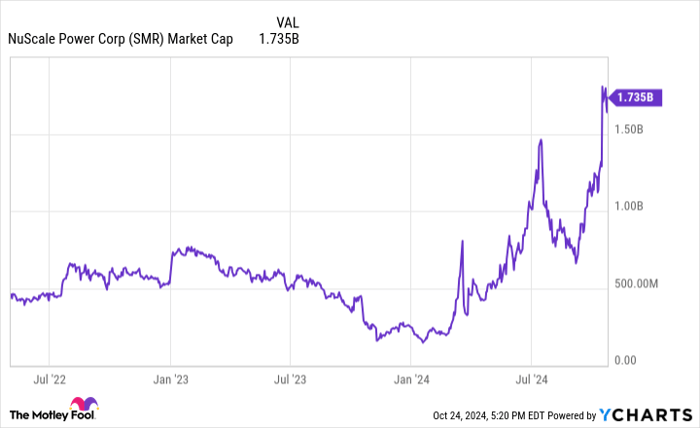

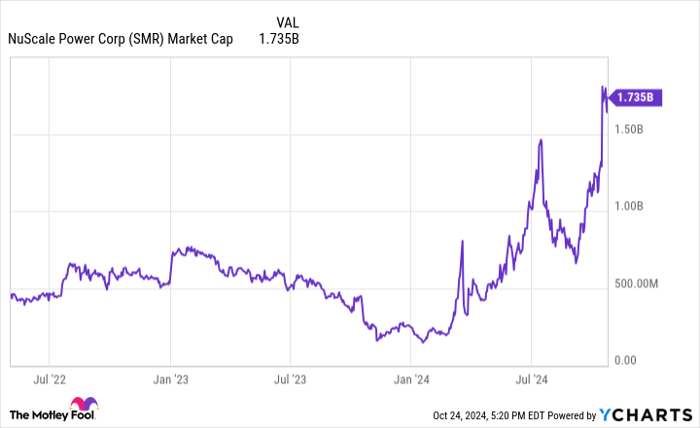

SMR Market Cap data by YCharts

Market Volatility: A Cautious Investment

Investors are currently focused on the potential upside of SMR technology, driving NuScale’s stock up nearly 500% over the past year. However, this enthusiasm may overshadow the considerable risks involved.

The company has a market cap of $1.7 billion but no revenue, and the likelihood of facing stock dilution or increased debt within the next year poses risks to longer-term investor returns.

Moreover, the efficacy of SMR technology remains unproven, and it is uncertain whether utility companies will prefer these smaller reactors over traditional large nuclear plants. While the concept is promising, it has yet to materialize into a profitable venture.

Investing Wisely: Is NuScale Right for You?

If you’re considering investing in NuScale Power, think carefully about your options.

The Motley Fool Stock Advisor recently identified what it considers the 10 best stocks to buy, with NuScale Power notably absent from this list. Historical examples, like Nvidia making the cut in 2005, illustrate how well-timed investments can yield extraordinary returns; a $1,000 investment in Nvidia in 2005 would now be worth approximately $867,372.*

Stock Advisor offers a clear framework for successful investing, delivering guidance on portfolio management and fresh stock picks each month. This service has notably outperformed the S&P 500 since 2002.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends NuScale Power and also has options related to Microsoft. Please refer to The Motley Fool’s full disclosure policy for more details.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.