Coca-Cola’s Pricing Power: Key to Success Despite Mixed Volume Trends

As Coca-Cola (NYSE: KO) reports its Q3 earnings, the company’s historical strength in pricing has continued to shine through, even as its stock saw a minor dip. The billion-dollar question is whether this strategy can be sustained moving forward.

An examination of Coca-Cola’s recent performance offers insights into this question.

Pricing Power Fuels Growth

Decades of marketing have made Coca-Cola one of the most recognized brands globally, and this branding has bolstered its pricing power. Despite only slight growth in case volumes, the company’s revenue has surged over the past couple of years, a trend that persisted in the third quarter.

In Q3, Coca-Cola’s organic revenue rose by 9%, even though case volumes fell by 1%. Earlier in the year, the company had seen modest case volume growth of 1% in Q1 and 2% in Q2.

Coca-Cola enjoyed a substantial 10% increase in price and mix during the quarter. However, 4% of that increase was attributed to extreme price inflation in certain markets. Overall, the company managed to implement price hikes across various regions, although foreign currency fluctuations diminished some of this impact outside North America.

In North America specifically, price/mix increased by 11%. This growth came from a balanced mix of increased prices and product selection. Notably, brands like Fairlife and Topo Chico recorded strong performances, enhancing product diversity.

Nevertheless, challenges emerging in markets like China, Mexico, and Turkey led to unit volume declines.

Looking forward, Coca-Cola has forecasted an impressive full-year organic revenue growth of 10% and currency-neutral adjusted EPS (earnings per share) growth between 14% and 15%. This outlook is an improvement from earlier estimates of 9% to 10% organic revenue growth. The expectation for adjusted EPS growth remains set at 5% to 6%.

For 2025, the company anticipates that price pressures from high inflation will ease, though it also expects rising costs for agricultural commodities.

Image source: Getty Images.

Assessing Coca-Cola Stock for Investors

Moving forward, the critical factor for Coca-Cola is whether it can sustain its pricing power. Even with slight volume declines, as long as the company remains adept at adjusting prices, it could continue to perform well.

This quarter marked the first instance since Q4 2022 where volumes shifted from growth to decline. While Coca-Cola might trade off some volume for price increases, this trend raises concerns if it accelerates further. The company cited weakness in China and Mexico as significant contributors to volume decreases. Despite this, Coca-Cola’s Latin America segment remains a growth engine, although the company attributed Mexico’s decline to a strong performance in the same period last year.

Looking ahead, Coca-Cola sees potential in ready-to-drink mixed alcoholic beverages, but the company warns it may take up to a decade to fully gauge the success of this category.

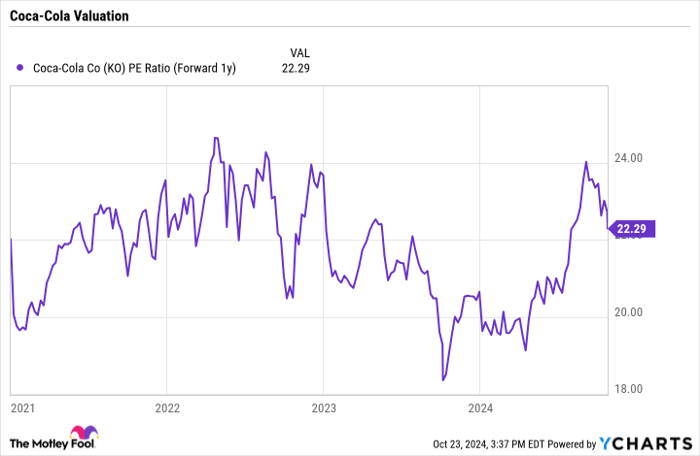

Given its defensive business structure and brand strength, Coca-Cola’s stock traditionally maintains a robust valuation. At present, it has a forward price-to-earnings (P/E) ratio of approximately 22, aligning with its historical trading patterns.

KO PE Ratio (Forward 1y) data by YCharts

Over the long term, Coca-Cola appears to be a solid investment given its pricing strengths. However, should volume declines significantly increase, it may prompt investors to reconsider their position, especially as declining volumes could jeopardize its pricing power.

Younger generations’ evolving tastes present another challenge that Coca-Cola will need to address. It will also be crucial to monitor performance in emerging markets. Currently, the situation does not suggest continuous volume declines; historical trends show the company rebounding after similar volume dips in late 2022.

At this juncture, one quarter of reduced volume isn’t indicative of a broader trend, making it less concerning for investors. Accordingly, Coca-Cola’s pricing power should endure, allowing investors to maintain confidence in this stock for the long haul.

Is Coca-Cola a Smart Investment for $1,000 Right Now?

Before investing in Coca-Cola, it’s wise to consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks to buy now, and Coca-Cola did not make this list. The selected stocks hold significant potential for growth in the coming years.

Take, for example, Nvidia, which was included in this recommendation on April 15, 2005. If you had invested $1,000 at that time, you would have seen that grow to $867,372!*

Stock Advisor offers an easy-to-follow investment strategy, including advice on portfolio building and regular analyst updates, alongside two new stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since its launch in 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.