Strategic Investing Made Simple: Uncovering Vanguard’s Top ETFs for Long-Term Gains

Building wealth for the future doesn’t have to be complicated. In fact, low-cost exchange-traded funds (ETFs) have shown to outperform many professional money managers consistently over time.

Research consistently indicates that passive index funds generally yield better financial results than actively managed funds when accounting for fees and expenses. Below are three exemplary Vanguard ETFs that showcase straightforward investing strategies while offering robust portfolio diversification.

Image source: Getty Images.

Cost-Effective Market Coverage

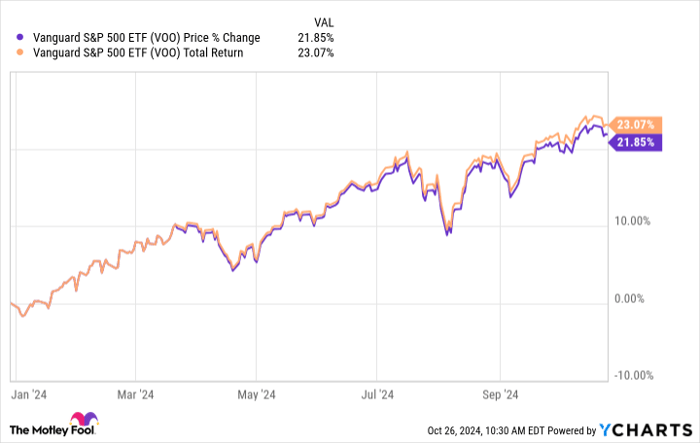

The Vanguard S&P 500 ETF (NYSEMKT: VOO) mirrors the performance of 500 of the largest U.S. firms, offering immediate diversification among top businesses in the country. Over the past decade, the fund has achieved approximately 13.3% in average annual returns, thanks to its impressively low expense ratio of 0.03%, far below the typical 0.78% for similar funds.

VOO data by YCharts.

Since its establishment in 2010, this ETF has maintained consistent performance across diverse economic conditions. The fund currently offers a yield of 1.23%, ensuring exposure to both innovative leaders and stable blue-chip companies. The broad array of stocks in this ETF reduces risks associated with individual stocks, while a median market capitalization of $262.2 billion emphasizes its commitment to well-established corporations.

Growth Potential Without Breaking the Bank

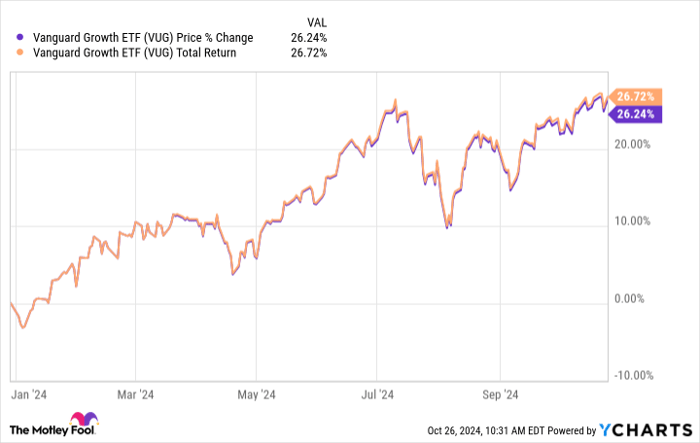

The Vanguard Growth ETF (NYSEMKT: VUG) focuses on top U.S. companies anticipated to grow faster than the average, guided by the CRSP U.S. Large Cap Growth Index. With an expense ratio of only 0.04%, it provides affordable access to some of the nation’s fastest-growing firms. This ETF holds 183 stocks with a median market capitalization of $1.4 trillion, targeting leaders in innovation across various sectors.

VUG data by YCharts.

Performance is notable, as this fund has delivered an average annual return of 15.54% over the last decade. Nearly 57.7% of the portfolio is invested in technology, with 18.4% in consumer discretionary. This distribution positions the ETF well to benefit from ongoing shifts in consumer spending and the digital economy, with portfolio holdings reflecting strong earnings growth at 23.5% over the past five years and a substantial return on investment of 134% during that period.

Investing in a Tech-Driven Future

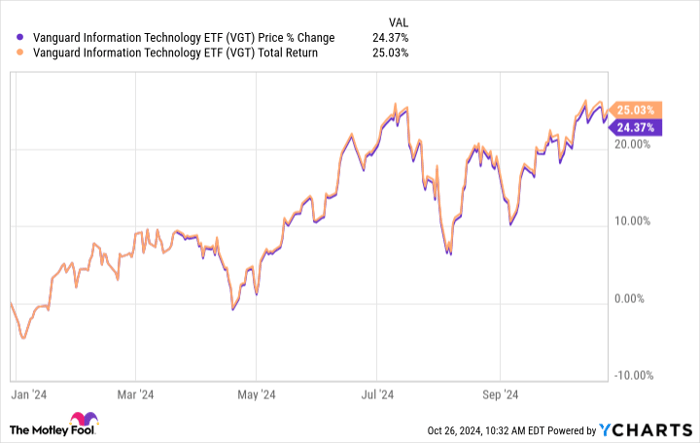

The Vanguard Information Technology ETF (NYSEMKT: VGT) concentrates on the tech industry’s significant growth potential. This targeted strategy has resulted in impressive average annual returns of 20.68% over the past ten years. Despite its focus, the fund remains well-diversified with 316 holdings across various technology sectors.

VGT data by YCharts.

The Vanguard Information Technology ETF boasts a low expense ratio of 0.10%, significantly below the average of 0.95% for similar funds. The portfolio is heavily weighted towards software, semiconductors, and hardware, ensuring exposure to critical areas of tech innovation. The ETF’s holdings show a solid earnings growth of 25.5% and a remarkable return on investment of 176% over the past five years.

By blending established tech giants with upcoming innovators, the fund allows investors to capitalize on both stability and growth. Its holdings include application software (14.9%), systems software (20.2%), and semiconductors (28.8%), highlighting its comprehensive exposure to the technology sector. The median market capitalization stands at $472.2 billion, showcasing a focus on both established leaders and emerging players in tech.

Key Points to Consider

These three Vanguard ETFs symbolize a blend of historical performance and promising growth potential, making them strong contenders for anyone looking to build wealth over time. With broad market exposure, targeted growth opportunities, and minimal costs, they lay a solid foundation for successful investing across diverse styles and sectors.

Seize This Opportunity Before It’s Gone

Ever feel like you missed out on investing in top-performing stocks? If so, there’s good news.

Occasionally, our expert analysts identify a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve already lost your chance to invest, now may be the perfect moment to act before it’s too late. The returns tell the story:

- Amazon: an $1,000 investment when we doubled down in 2010 would now be worth $21,154!*

- Apple: if you invested $1,000 in 2008, today you’d have $43,777!*

- Netflix: an investment of $1,000 in 2004 would be worth $406,992!*

Three incredible companies are being recommended right now, and opportunities like this may not last long.

Find out about these 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

George Budwell has positions in Vanguard S&P 500 ETF and Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.