Stock Splits: The Trend Gaining Momentum Among Leading Companies

This year has witnessed significant stock splits from major companies like Nvidia and Walmart, while Chipotle Mexican Grill executed one of the largest splits in New York Stock Exchange history with a 50-for-1 split. But why do companies make such a move? Stock splits allow companies to reduce their share price without changing the overall market value. This approach helps make shares more affordable for a wider array of investors.

It’s important to note that stock splits typically do not lead to immediate stock price increases. They are viewed positively, however, as they can attract more investors over time, especially if the stock is priced more accessibly. Additionally, a stock split often indicates a company’s confidence in its future growth prospects, suggesting a potential for the stock to rise from its new lower price.

Look Out for Future Splits: Health Companies May Be Next

Investors continuously monitor stock split announcements. Some healthcare stocks are now positioned for splits after reaching impressive price levels, including above $900 and $1,000. Let’s explore two significant players in this sector.

Image source: Getty Images.

1. Eli Lilly

Eli Lilly (NYSE: LLY) has experienced four stock splits in its history, the latest occurring back in 1997. Presently, Lilly’s shares are trading around $900, just shy of a record peak of roughly $960 achieved earlier this month. This high price can deter some investors, and thresholds near $1,000 often create psychological barriers, making stocks seem too expensive even if they are fairly valued.

Recently, Lilly’s stock has surged from about $250 just two years ago. A primary driver behind this rise is Lilly’s success in the growing weight loss drug market. The company’s tirzepatide, marketed as Mounjaro for type 2 diabetes and Zepbound for weight loss, contributed over $4 billion in revenue last quarter.

Looking ahead, the weight loss drug segment could expand 16 times to reach $100 billion by 2030, according to Goldman Sachs Research. A stock split could open doors for more investors to join in, potentially fueling further gains.

2. Regeneron Pharmaceuticals

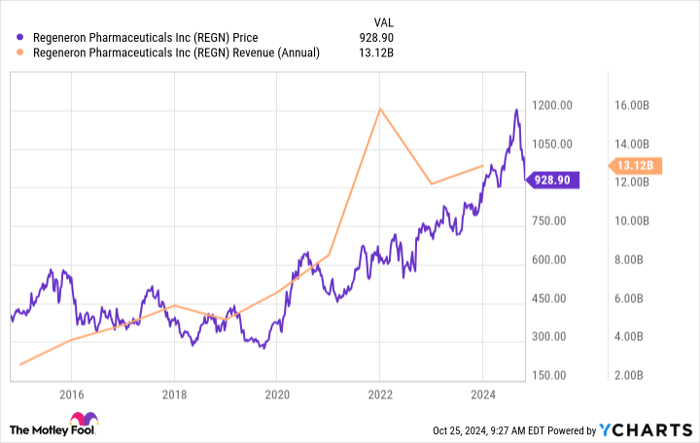

Regeneron Pharmaceuticals (NASDAQ: REGN) has maintained a stock price above $500 for most of the past eight years. Recently, it has traded above $900 and even exceeded $1,000 at times. Despite this, Regeneron has never initiated a stock split.

REGN data by YCharts

With its stock now at an all-time high, you might think a split would be a smart strategy. Regeneron recently launched a higher-dose version of its popular eye disease drug Eylea as it faces increased competition, especially from Roche’s Vabysmo and Amgen’s biosimilar.

While the new Eylea HD could help offset pressure from its predecessor, potential investors might hesitate given that the two Eylea products accounted for 43% of the company’s latest quarter’s revenue.

It’s essential to recognize that biotech companies often experience the highs and lows of blockbuster drugs that eventually face competition. Regeneron, however, has a robust portfolio including eczema drug Dupixent, which saw double-digit revenue growth recently. With 35 candidates in clinical development, Regeneron appears well-positioned for future growth. A stock split could further boost investor interest in this strong company.

A Chance to Consider New Investments

Have you ever felt like you missed out on the opportunity to invest in top-performing stocks? Here’s a chance to act.

On rare occasions, our expert analysts issue a “Double Down” stock recommendation for companies poised for significant growth. If you’re worried about missing out on potential profits, now could be a crucial time to invest. The numbers tell a powerful story:

- Amazon: If you invested $1,000 back in 2010, you would now have $21,154!

- Apple: An investment of $1,000 in 2008 would have grown to $43,777!

- Netflix: $1,000 invested in 2004 could now be worth $406,992!

We are currently issuing “Double Down” alerts for three exceptional companies, underscoring that there may not be another opportunity like this for some time.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Goldman Sachs Group, Nvidia, and Walmart. The Motley Fool recommends Amgen and Roche Holding AG and suggests the following options: short December 2024 $54 puts on Chipotle Mexican Grill. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.