Invesco FTSE RAFI US 1000 ETF Shows Analyst Upside Potential

At ETF Channel, we analyzed the underlying holdings of various ETFs to determine their projected performance. For the Invesco FTSE RAFI US 1000 ETF (Symbol: PRF), we calculated an implied analyst target price of $44.56 per unit based on its holdings.

Current Market Position and Price Projections

Currently, PRF trades around $40.57 per unit. This suggests that analysts anticipate a 9.83% increase for this ETF based on average price targets of its underlying holdings. Noteworthy among these holdings are three stocks predicted to rise significantly: StoneCo Ltd (Symbol: STNE), Tronox Holdings PLC (Symbol: TROX), and Nomad Foods Ltd (Symbol: NOMD).

Stock Performance and Analyst Expectations

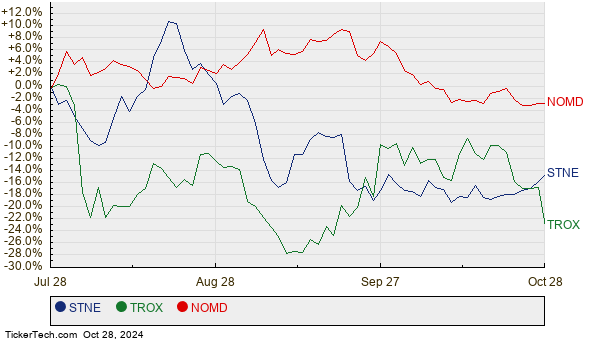

StoneCo Ltd is currently priced at $11.46 per share, yet analysts have a target of $17.20 per share, indicating a potential upside of 50.09%. Tronox Holdings PLC also shows promise; priced at $12.41 per share, it has a target of $17.25, representing a 39.00% upside. Similarly, Nomad Foods Ltd, trading at $17.56, has a target price of $24.17, which suggests an upside of 37.62%. Below is a twelve-month price history chart comparing the stock performance of STNE, TROX, and NOMD:

Summary of Analyst Targets

The table below summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco FTSE RAFI US 1000 ETF | PRF | $40.57 | $44.56 | 9.83% |

| StoneCo Ltd | STNE | $11.46 | $17.20 | 50.09% |

| Tronox Holdings PLC | TROX | $12.41 | $17.25 | 39.00% |

| Nomad Foods Ltd | NOMD | $17.56 | $24.17 | 37.62% |

Understanding Analyst Price Targets

Are these analyst targets realistic, or do they hint at overoptimism regarding these stocks? It’s important to consider whether the targets reflect valid expectations based on recent industry developments or if they are based on outdated information. High target prices relative to current trading prices may showcase optimism but can also signal potential downgrades if they fail to account for market changes. Investors should conduct thorough research to form their own conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Holdings Channel

• Funds Holding CULP

• UFCS Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.