In our analysis of the ETFs at ETF Channel, we examined the trading prices of their underlying holdings compared to the average analyst 12-month forward target prices. For the ProShares S&P MidCap 400 Dividend Aristocrats ETF (Symbol: REGL), the estimated analyst target price based on these holdings is $88.68 per unit.

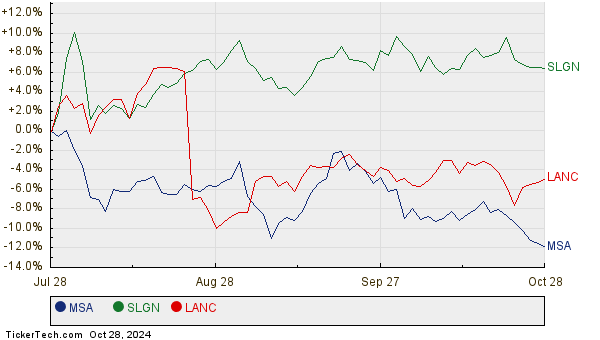

Currently, REGL is trading at around $80.83 per unit, indicating a potential upside of 9.72% according to analysts’ forecasts of the underlying stocks. Among REGL’s holdings, MSA Safety Inc (Symbol: MSA), Silgan Holdings Inc (Symbol: SLGN), and Lancaster Colony Corp (Symbol: LANC) show significant upside potential. For instance, MSA has a recent trade price of $166.12 per share, but analysts have set an average target of $195.00 per share, reflecting a 17.39% increase. Similarly, SLGN, currently priced at $50.90, has an upside of 15.91% to a target of $59.00 per share. Analysts also expect LANC, currently at $177.21, to rise to $201.50 per share, representing a 13.71% increase. A performance chart comparing MSA, SLGN, and LANC over the last twelve months is included below:

Combined, these three companies constitute 5.84% of the ProShares S&P MidCap 400 Dividend Aristocrats ETF. Below is a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares S&P MidCap 400 Dividend Aristocrats ETF | REGL | $80.83 | $88.68 | 9.72% |

| MSA Safety Inc | MSA | $166.12 | $195.00 | 17.39% |

| Silgan Holdings Inc | SLGN | $50.90 | $59.00 | 15.91% |

| Lancaster Colony Corp | LANC | $177.21 | $201.50 | 13.71% |

This leads to deeper questions: Are analysts being realistic with their price targets, or might they be overestimating future stock values? Moreover, have analysts overlooked recent developments in these companies or their industries? While high price targets can indicate optimism, they also risk becoming overly ambitious if they do not reflect current market conditions or outlooks. Investors are encouraged to conduct further research to analyze these aspects.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SKYE YTD Return

• MJNE Options Chain

• ATUS Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.