Unpacking Netflix’s Stock Ratings: Are Analyst Recommendations Useful?

Investors often look to Wall Street analysts for guidance on whether to buy, sell, or hold a stock. News about changes in these analysts’ ratings can impact stock prices. But how reliable are these recommendations?

Let’s first examine what analysts currently think about Netflix (NFLX).

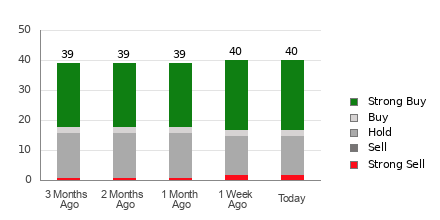

Netflix has an average brokerage recommendation (ABR) of 1.89, on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This rating is based on the recommendations from 40 brokerage firms, with an average falling between Strong Buy and Buy.

Out of these 40 recommendations, 23 are Strong Buy and 2 are Buy, which equals 57.5% and 5% respectively.

Current Ratings Analysis for NFLX

While the ABR suggests buying Netflix, it’s important not to base investment decisions solely on this figure. Research shows that brokerage recommendations often fail to effectively guide investors toward stocks that will rise in price.

Why is this the case? Analysts working for brokerage firms often have a bias stemming from their firms’ interests in the stocks they cover. Studies reveal that for every “Strong Sell,” there are about five “Strong Buy” recommendations made by these analysts.

This divergence may indicate that the interests of brokerages do not always align with those of average investors, providing limited insight into future stock performance. Investors are encouraged to use these recommendations as a supplementary tool alongside their personal analysis.

To aid in creating a more informed investment strategy, the Zacks Rank can be an effective resource. This proprietary rating system categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is based on a reliable track record of performance.

Understanding Zacks Rank vs. ABR

Though both Zacks Rank and ABR use a scale from 1 to 5, they serve different purposes.

The ABR is primarily derived from broker recommendations and displayed in decimal form (like 1.28), while Zacks Rank is a quantitative model that incorporates earnings estimate revisions, represented as whole numbers.

Brokerage analysts have a tendency to be overly optimistic. Often their recommendations exceed what their research would actually support. This discrepancy frequently misleads rather than guides investors.

A contrast can be drawn with Zacks Rank, which is grounded in earnings estimate revisions. Extensive research shows that trends in these revisions strongly correlate with near-term price movements in stocks.

Additionally, the Zacks Rank applies consistently across stocks analyzed by brokers for the current year, maintaining a balanced distribution among its five rank categories.

Another key difference between ABR and Zacks Rank lies in the freshness of the data. While ABR may not always reflect the latest updates, Zacks Rank quickly incorporates revisions made by analysts to earnings estimates, making it a timely metric for projecting future stock prices.

Should You Invest in NFLX?

As for Netflix, the Zacks Consensus Estimate for the current year’s earnings has risen by 3.6% in the past month, now sitting at $19.78.

Analysts’ increasing optimism about Netflix’s earnings, as indicated by a consensus shift in higher EPS estimates, suggests the stock could perform well in the upcoming months.

This shift, among other key factors, has resulted in a Zacks Rank of #2 (Buy) for Netflix, indicating positive potential. For further insights, you can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks.

Thus, the Buy-equivalent ABR for Netflix may be a helpful tool for investors as they consider their options.

Access Zacks Stock Recommendations for Just $1

We are serious about this offer.

In an unexpected move, we once provided our members with 30-day access to all stock picks for only $1, without any further obligation.

Many investors have seized this opportunity; some doubted it, thinking there must be a catch. We encourage you to experience our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which closed 228 positions with significant gains in 2023.

Interested in the latest recommendations from Zacks Investment Research? Download our guide on 5 Stocks Set to Double.

Netflix, Inc. (NFLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.