Advanced Micro Devices Poised for Strong Q3 Results

Advanced Micro Devices (AMD) is expected to report impressive Data Center revenues for the third quarter of 2024, with figures set to be released on October 29.

The company is well-positioned due to its diverse product lineup and growing partnerships. By utilizing its fourth-generation EPYC CPUs, AMD is enhancing its presence in the enterprise data center market.

AMD and its partners are working together to provide solutions that streamline data center operations. Notable developments include the Instinct MI300 Series data center AI accelerators and the Alveo V80 accelerators aimed at the embedded market. Major partners like Dell Technologies (DELL), HPE, Lenovo, and Supermicro are already utilizing the Instinct platforms.

According to the Zacks Consensus Estimate, AMD’s Data Center revenues are projected to reach $3.43 billion, reflecting a significant year-over-year increase of 114.77%.

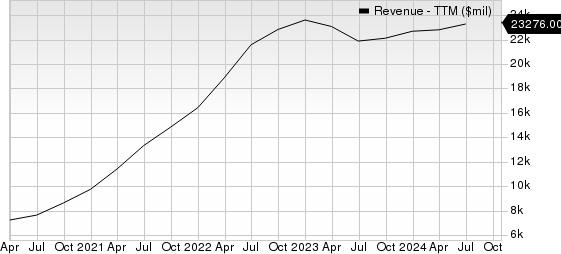

AMD Revenue Trends

Revenue Trajectory of Advanced Micro Devices, Inc.

Stay informed about upcoming earnings announcements with the Zacks Earnings Calendar.

Discover AMD’s projected third-quarter performance.

Broadening Product Range to Boost Client Revenues

AMD’s growth is largely attributed to an expanding product range, especially in the Client segment.

Recently, AMD launched the Ryzen AI 300 Series and the Ryzen 9000 Series processors, enhancing its mobile and desktop offerings.

The Ryzen AI 300 Series stands out with its remarkable 50 tops of AI compute performance for Copilot Plus PCs, earning the title of the industry’s fastest NPU.

The consensus estimate for Client revenues in Q3 2024 stands at $1.798 billion, suggesting a year-over-year growth of 46.18%.

Challenges from Declining PC Sales

Despite strong performances in certain sectors, AMD may face hurdles from a softening PC market.

Although there is a recovery in the global economy, shipments of traditional PCs have declined. According to the latest report from IDC, 68.8 million traditional PCs were shipped globally in Q3 2024, down 2.4% year over year.

Lenovo led the shipment rankings, followed closely by HP (HPQ) and Dell Technologies regarding market share. Lenovo, HP, Dell, ASUS, and Apple (AAPL) held 24%, 19.7%, 14.3%, 7.9%, and 7.8% market shares, respectively.

Lenovo and HP saw growth in shipments of 3% and 0.4%, respectively. Conversely, Dell Technologies experienced a 4% decline. ASUS, however, experienced a strong 10% increase, while Apple faced a steep fall of 24.2%, marking the most significant decrease in the list.

What’s Next for AMD Investors?

Despite anticipated strong revenues from its Data Center and Client segments, AMD’s overall growth could be hampered by weaknesses in the Embedded and Gaming sectors.

The downturn in PC sales poses additional challenges for AMD, which currently holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Try Zacks’ Recommendations for Just $1

No gimmicks here. A few years ago, we surprised our members by offering 30-day access to all our stock picks for only $1, with no further obligations.

Thousands seized the opportunity, while others hesitated, thinking there was a catch. Our reason? We want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which achieved double- and triple-digit gains on 228 positions in 2023.

Check out Stocks Now >>

For the latest recommendations from Zacks Investment Research, you can download the report on 5 Stocks Set to Double for free.

Apple Inc. (AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

HP Inc. (HPQ): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.