Colgate-Palmolive Faces Downgrade as Financial Outlook Adjusts

Fintel reports that on October 28, 2024, Stifel downgraded their outlook for Colgate-Palmolive (XTRA:CPA) from Buy to Hold.

Analysts Predict Modest Price Growth

As of October 22, 2024, analysts have set an average one-year price target for Colgate-Palmolive at 100.96 €/share. The projections vary widely from a low of 83.51 € to a high of 117.68 €. This average suggests potential growth of 13.44% based on the company’s latest closing share price of 89.00 €.

Revenue and Earnings Projections

Colgate-Palmolive is projected to achieve annual revenue of 20.163 million euros, reflecting a slight increase of 0.28%. Furthermore, the expected annual non-GAAP earnings per share (EPS) stands at 3.51.

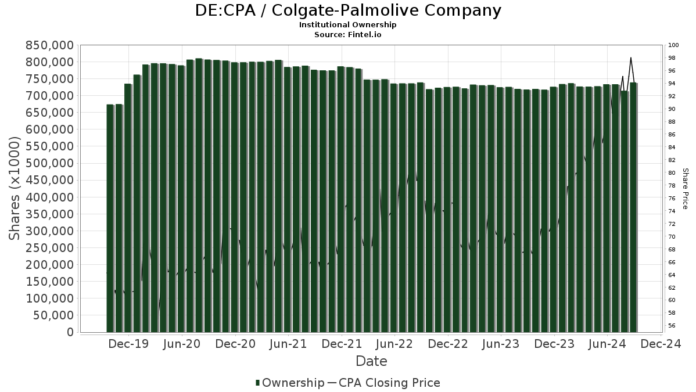

Insights from Institutional Holdings

As of now, 2,831 funds and institutions have positions in Colgate-Palmolive, marking an increase of 90 owners or 3.28% in just the last quarter. The average portfolio allocation of all funds for CPA is 0.34%, which shows a slight increase of 0.16%. Additionally, total institutional shares rose by 3.97% over the past three months, totaling 741,502,000 shares.

Price T Rowe Associates currently holds 38,253,000 shares, accounting for 4.68% of the company. This figure is a decrease from their previous holding of 41,067,000 shares, which is a drop of 7.36%. Their portfolio allocation for CPA has seen a reduction of 2.00% over the last quarter.

Meanwhile, Vanguard Total Stock Market Index Fund Investor Shares owns 25,854,000 shares, representing 3.16% ownership. This is a slight decline from 25,889,000 shares previously reported, translating to a decrease of 0.14%. However, their portfolio allocation in CPA increased by 4.65% last quarter.

Vanguard 500 Index Fund Investor Shares possesses 21,057,000 shares, making up 2.58% of Colgate-Palmolive. Their holdings reflect an increase from 20,749,000 shares, amounting to 1.46% growth. Their CPA portfolio allocation rose by 3.53% in the same period.

Geode Capital Management’s shareholding is 19,640,000 shares, or 2.40% ownership, which indicates an increase from 19,096,000 shares, marking a growth of 2.77%. Their allocation for CPA also went up by 5.20% in the last quarter.

In contrast, Wellington Management Group LLP’s stake has significantly decreased from 27,824,000 shares to 16,581,000 shares, a drop of 67.80%. They’ve cut their allocation for CPA by an alarming 90.88% recently.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisers, and small hedge funds.

Our data covers global fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and much more, all aimed at guiding investment decisions. Exclusive stock picks benefit from advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.