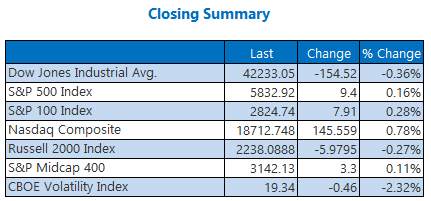

Mixed Market Performance as Nasdaq Hits Record High

Stocks ended the day with varied results. The Dow struggled to regain its ground, while the S&P 500 managed to secure a solid gain. Meanwhile, the tech-heavy Nasdaq soared with a significant uptick, marking its fourth consecutive winning day and reaching a record high ahead of major earnings reports from companies like Alphabet (GOOGL), Advanced Micro Devices (AMD), and Snap (SNAP), all set to announce after the market closes.

Explore further details on today’s market updates:

- New developments in the homebuilding sector.

- Nuclear stocks poised to enhance AI technologies.

- Insights into the fintech sector shake-up, Ford’s stock decline, and a betting stock preparing for a rebound.

Market Highlights for Today

- September jobs data saw a sharp decline, the biggest since early 2021, dropping to 7.44 million compared to a revised 7.86 million the previous month. (Bloomberg)

- The Conference Board reported that October’s consumer confidence index experienced its largest monthly increase since March 2021, rising to 138. (CNBC)

- Two companies making waves in the fintech sector.

- Ford Motor stock slips on disappointing forecasts.

- DraftKings stock appears set for a rebound.

Oil Prices Recover After Recent Declines

Today, oil prices began to recover following significant losses caused by recent geopolitical tensions involving Israel and Iran. November-dated West Texas Intermediate (WTI) crude rose 17 cents, or 0.3%, to $67.21 per barrel.

Gold prices also surged, reaching a record high, driven by anticipation of the upcoming U.S. elections and speculation about future interest rate cuts. As of the latest update, gold for December delivery was trading up 0.9% at $2,779.50.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.