Tesla’s Short Sellers Reeling After Two-Day Stock Surge

Following a two-day surge, short sellers of Tesla (TSLA) faced staggering losses totaling $3.5 billion. Tesla announced stronger than anticipated Q3 FY24 earnings on October 23, prompting a remarkable 22.3% rise in its share price in a mere two trading days. This rally wiped out the annual gains for many short sellers, with some even reporting losses.

A recent report from S3 Partners revealed that short sellers absorbed $1.7 billion in lost accumulated profits this year alone, alongside $1.8 billion in mark-to-market losses. Analysts had predicted a 10% decline in earnings for Tesla. However, the company surprised the market with a 9% year-over-year revenue increase. Many investors are now questioning whether Tesla’s optimistic delivery outlook for 2025 indicates an end to the declining demand for electric vehicles. The stock’s market capitalization surged by $150 billion in a single day, marking the largest one-day increase since 2013.

Analysts Divided on Tesla’s Future

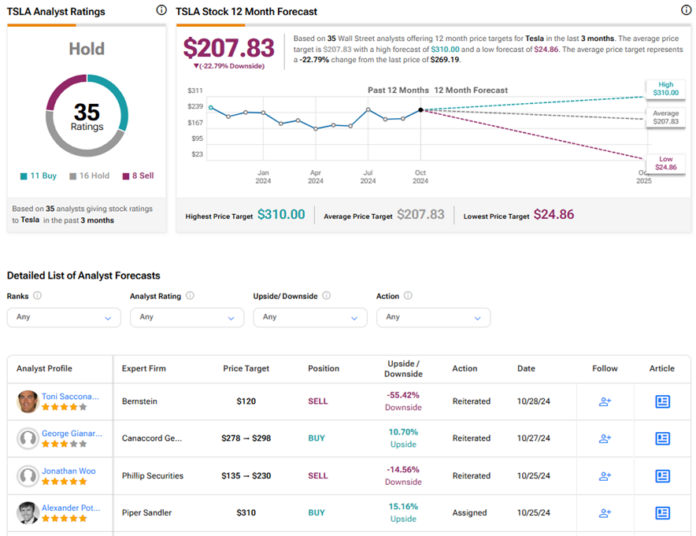

Despite the impressive earnings report, opinions among analysts remain mixed. Post-release, four analysts rated Tesla as a Buy, two as a Sell, and four as a Hold.

Bernstein analyst Toni Sacconaghi maintained a Sell rating on Tesla, setting a price target of $120, suggesting a 55.4% potential decline from current levels. Sacconaghi highlighted that while Tesla’s Q3 margins showed improvement, he anticipates minimal progress in the upcoming quarters. He expressed concerns over Tesla’s valuation, which heavily relies on its self-driving technology and plans for humanoid robots. This skepticism underpins his cautious outlook.

Conversely, Canaccord Genuity analyst George Gianarikas reaffirmed a Buy rating and raised the price target from $278 to $298, indicating a 10.7% potential increase. He remains optimistic about Tesla’s diverse future ventures spanning electric vehicles, artificial intelligence, energy storage systems, and humanoid robotics. This adjustment is supported by an increase in the projected 2026 price-to-earnings multiple from 34x to 36x.

Investing in Tesla: Buy, Hold, or Sell?

Amidst these differing perspectives, TSLA stock holds a consensus rating of Hold on TipRanks, supported by 11 Buy ratings, 16 Holds, and 8 Sell ratings. The average price target for Tesla stands at $207.83, suggesting a 22.8% downside from current market prices. Year-to-date, Tesla shares have appreciated by 8.3%.

See more TSLA analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.