Piper Sandler Boosts Leggett & Platt to Neutral with Promising Price Forecast

Analyst Predicts Modest Gains Ahead

On October 30, 2024, Fintel reported that Piper Sandler upgraded Leggett & Platt (NYSE:LEG) from Underweight to Neutral. The average one-year price target is now set at $12.92 per share, suggesting a 6.43% increase from the current closing price of $12.14 per share. The targets range from a low of $11.11 to a maximum of $14.70.

Strong Revenue Growth Expected

Leggett & Platt’s projected annual revenue stands at $5,415 million, reflecting a substantial growth of 21.90%. The estimated non-GAAP earnings per share (EPS) is anticipated to be $2.52.

Institutional Interest on the Rise

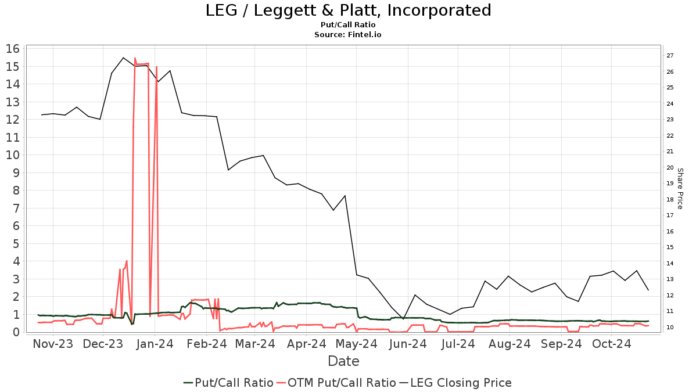

Currently, 712 funds or institutions hold positions in Leggett & Platt, a slight rise of 12 shareholders or 1.71% since last quarter. The average portfolio weight for these funds in LEG has grown by 11.16% to 0.07%. Notably, institutional ownership has surged, with total shares owned increasing by 27.39% over three months to 126,831,000 shares. The put/call ratio for LEG is at 0.66, indicating a generally bullish sentiment among investors.

Shareholder Actions Highlight Increased Interest

Pacer Advisors owns 14,042,000 shares of Leggett & Platt, accounting for 10.47% of the company. This marks an impressive 81.00% increase from their previous filing, showcasing a portfolio allocation increase of 210.40% in just one quarter.

Other significant shareholders include CALF – Pacer US Small Cap Cash Cows 100 ETF with 9,187,000 shares (6.85% ownership), and IJR – iShares Core S&P Small-Cap ETF holding 8,668,000 shares (6.46% ownership). COWZ – Pacer US Cash Cows 100 ETF has increased its stake to 4,866,000 shares (3.63% ownership), reflecting a 42.23% rise from their previous filing with a portfolio allocation increase of 13.98%. Conversely, Charles Schwab Investment Management slightly increased its ownership by 2.70%, now holding 4,554,000 shares, but reduced its portfolio allocation in LEG by 57.67%.

About Leggett & Platt

(Description provided by the company.)

Leggett & Platt is a diversified American manufacturer known for designing and producing numerous engineered components that find use in both homes and vehicles. Their product range includes steel rods, foam chemicals, innersprings, and adjustable beds, among others. The company caters to a wide array of clients, from big box retailers to specialized bedding brands.

Fintel serves as a major investing research platform that provides comprehensive data, analyst reports, and insights into fund sentiment, aimed at equipping investors, financial advisors, and small hedge funds with crucial market information.

For more insights, click to learn more.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.