An Analysis of the First Trust RBA American Industrial Renaissance ETF’s Potential Growth

As we examine the underlying assets of various ETFs, the First Trust RBA American Industrial Renaissance ETF (Symbol: AIRR) has caught our attention. Based on recent evaluations, the analyst’s 12-month target price for AIRR is set at $89.67 per unit.

Current Trading Status and Analyst Outlook

Trading near $80.83 per unit, AIRR has a potential upside of 10.94%, as indicated by analysts’ target prices for its underlying stocks. Among these stocks, Limbach Holdings Inc (Symbol: LMB), VSE Corp. (Symbol: VSEC), and DNOW Inc (Symbol: DNOW) stand out for their significant upside potential. For example, LMB recently traded at $90.61 per share but has an average target of $111.50 per share, suggesting a potential increase of 23.05%. VSEC’s current price of $109.38 reflects a potential 16.11% upside if it reaches the target of $127.00 per share. Meanwhile, DNOW, with a recent price of $13.80, has an average target of $15.67, indicating an upside of 13.52%.

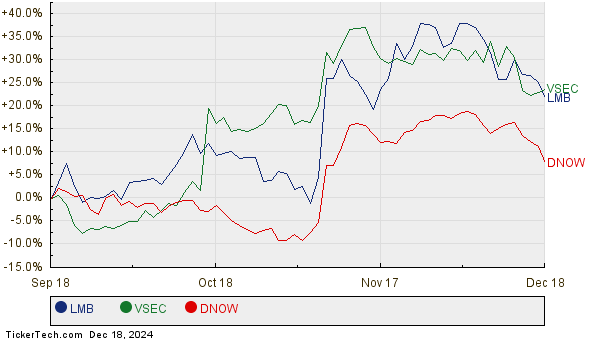

Comparative Price Performance of Selected Stocks

The following chart illustrates the performance over the past year for LMB, VSEC, and DNOW:

Summary of Analyst Targets

The table below summarizes the recent prices and average analyst targets for AIRR and its holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust RBA American Industrial Renaissance ETF | AIRR | $80.83 | $89.67 | 10.94% |

| Limbach Holdings Inc | LMB | $90.61 | $111.50 | 23.05% |

| VSE Corp. | VSEC | $109.38 | $127.00 | 16.11% |

| DNOW Inc | DNOW | $13.80 | $15.67 | 13.52% |

Evaluating Analyst Predictions

Are these price targets realistic, or do they reflect an overly optimistic view? Analysts’ expectations might be grounded in recent market performance, but it is essential for investors to consider various factors before making decisions. When a stock’s target price greatly exceeds its market price, it may suggest optimism, but it could also lead to future downgrades if those targets fail to materialize. Such considerations require thorough research and analysis on the part of investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Market News Video

• XEC Stock Predictions

• NSPR YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.